The SPDR Kensho Smart Mobility ETF (XKST) was launched to the market at the end of last year/2017, “it focuses on smart transportation firms, which the index provider fines as those companies advancing products or services in the following areas: autonomous vehicle technology, drone transportation technology, and advanced transportation tracking and transport optimization systems. Each company is further classified as either “core” or “non-core,” depending on the level of involvement in innovative transportation. The index equally weights each stock, but then re-assigns 20% of the non-core firms’ weight equally to the core firms. As a result, pure plays are overweighted. For a transportation sector fund with a twist towards innovative technology, XKII is reasonably priced.” – according to the ETF.com description.

The underlying index/benchmark is the Kensho Smart Transportation Index (the “Index”), which is comprised of U.S.-listed equity securities (including depositary receipts) of companies domiciled across developed and emerging markets worldwide which are included in the Smart Transportation sector as determined by a classification standard produced by Kensho Technologies, Inc. The Index is designed to capture companies whose products and services are driving innovation behind smart transportation.

According to its methodology, the index is rules-based, reflecting advances in the transportation sector, composed of companies focused on autonomous and electric vehicle technology, commercial drones, and advanced transportation systems. The detailed steps are:

1. Identifying all securities from each of the following New Economy indices: Advanced TransportSystems (KATS), Autonomous Vehicles (KCARS), Drones (KDRONE), Electric Vehicles (KEV)

2. Eliminating securities that do not cohere with the Index Objectives

3. Eliminating duplicates from the resultant list of components derived in Step 24. Deriving the category for each component by assuming the same categorization as indicated in its original sub-index. If a component appears in multiple sub-indices and it has been categorized as “Core” in any of them, then that company will be categorized as “Core”, otherwise, it will be categorized as “Non-Core”

Then liquidy criteria is imposed:

- USD 100 million minimum market capitalization threshold as of the relevant Selection Day, where the market capitalization is calculated as the number of shares outstanding multiplied by the closing price

- USD 1 million minimum 3-month average daily traded value (ADTV) threshold as of the relevant Selection Day, where the 3-month ADTV is calculated as the average of the number of shares traded each day multiplied by that day’s volume-weighted average price (VWAP) over the 63 Trading Days prior to the relevant Selection DayThe Index is rebalanced to reflect the eligible securities selected for inclusion in the Index on the RebalanceDay immediately following each Selection Day.

XKST contains 56 components:

| Aerovironment Inc Com |

| Tesla Inc Com |

| Trimble Inc Com |

| Rogers Corp Com |

| Fortive Corp Com |

| Wabco Holdings Inc Com |

| Honda Motor Co Ltd Ny Sh |

| Sirius Xm Holdings Inc Com |

| Yandex Nv Cl A |

| Borgwarner Inc Com |

| Ford Motor Co Com |

| American Axle & Mfg Holdings Com |

| Gentherm Inc Cl A |

| Aptiv Plc Com |

| Avis Budget Group Inc Com |

| Lear Corp Com |

| Hertz Global Holdings Inc Com |

| Nuance Communications Inc Com |

| Plug Power Inc Com |

| Heico Corp Com |

| Rockwell Collins Inc Com |

| Johnson Controls Intl Plc Com |

| Calamp Corp Com |

| Luxoft Holding Inc Cl A |

| Toyota Motor Corp Sponsored Adr |

| Ansys Inc Com |

| Alphabet Inc Cl A |

| Analog Devices Inc Com |

| Orbcomm Inc Com |

| Abb Ltd Sponsored Adr |

| Royal Dutch Shell Plc Spons Adr A |

| General Motors Co Com |

| Texas Instruments Incorporated Com |

| Intel Corp Com |

| Comtech Telecommunications Corp Com |

| Fiat Chrysler Automobiles Nv Com |

| Modine Manufacturing Co Com |

| Baidu Inc Sponsored Adr |

| Solaredge Technologies Inc Com |

| On Semiconductor Corp Com |

| Nxp Semiconductors Nv Com |

| Xperi Corp Com |

| Arcelormittal Sa Ny Reg Cl A |

| Ambarella Inc Com |

| Visteon Corp Com |

| Tata Motors Ltd Sponsored Adr |

| Stmicroelectronics Nv Ny Reg |

| Nvidia Corp Com |

| Hyster Yale Materials Handling Cl A |

| Ballard Power Systems Inc Com |

| Orix Corp Adr |

| Veoneer Inc Com |

| Delphi Technologies Plc Com |

| Ituran Location & Control Ltd Ord |

| Mix Telematics Ltd Sponsored Adr |

| Iteris Inc Com |

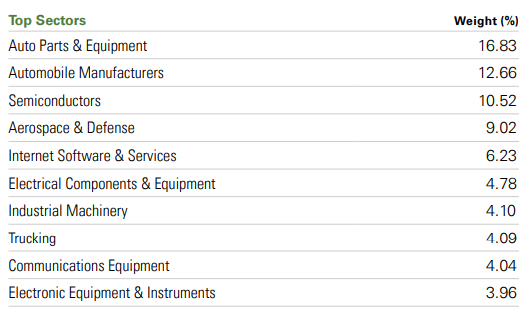

The distribution across industries is

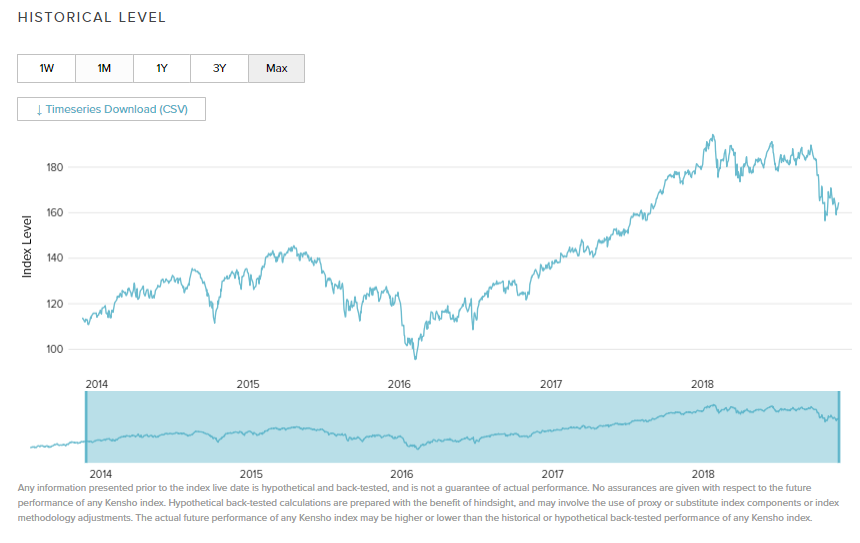

The yield to date is not boastful at -8.5% even the backtesting performance looked promising: