One is an equity mutual fund and the other bond fund. What bothers many retail investors is that they are skeptical and wary of broker’s suggestions, however, really not sure about how to choose and make decisions.

For example, FSNUX this mutual fund lag behind SPY significantly yet the commission fee is about 0.63%. So it’s really not a wise choice if there is SP500 index fund to opt for.

LSBRX is perplexing for me because it’s return has been disastrous for years, why there are still $9.39 Billion AuM with a high fee of 0.93%. It’s self-suicidal to keep such a bad fund. Also one needs to be aware “Bond funds have no maturity date, so there is no promise that you will get your money back. In fact, in a rising interest rate environment, bond fund share prices can fall and may never rise back to the price you paid. With bond funds, you also have no control over how long bonds will be held.”

Take a look at a few bond funds’ performance

Even LSBRX’s is horrible, LQD’s not bad. Why? According to an article in etf.com, “It’s no surprise then that corporate bond ETFs have held up well this year. The iShares iBoxx USD Investment Grade Corporate Bond ETF (LQD) was last trading with a year to date gain of 8.1%. The iShares iBoxx USD High Yield Corporate Bond ETF (HYG) was down 1.3% in the same period, but that’s still quite impressive in the current economic environment.”, to be more clear how the Fed prop up the price, here is the list of bond ETFs held/salvaged by the Fed as of July 2020:

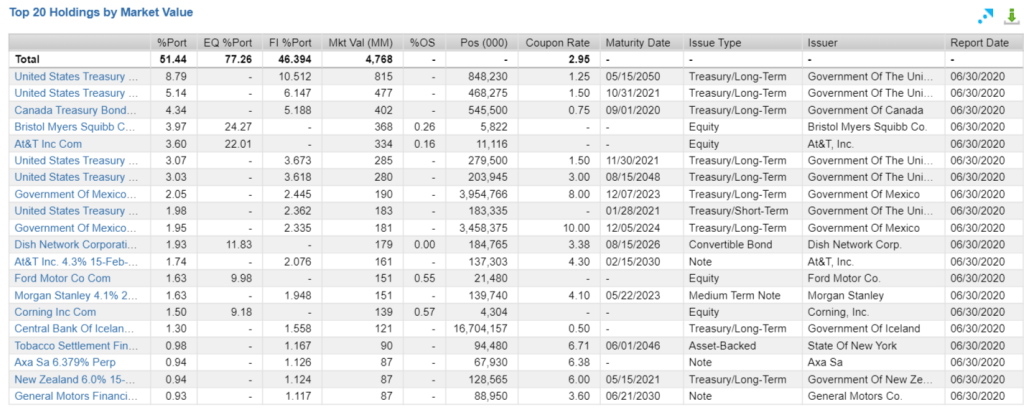

Why LSBRX’s return keeps diving down, I want to take apart of its composition, here is what it looks like as of June 2020. It strikes me that this mutual fund is “actively” managed by a mediocre PM. Fixed income takes as high as 82% but obviously the lower-yield macro-environment didn’t help push up its performance.

Now what is the makeup of FSNUX? It’s a fund of fund.

In conclusion, mutual fund is not an optimal channel for growing your assets.