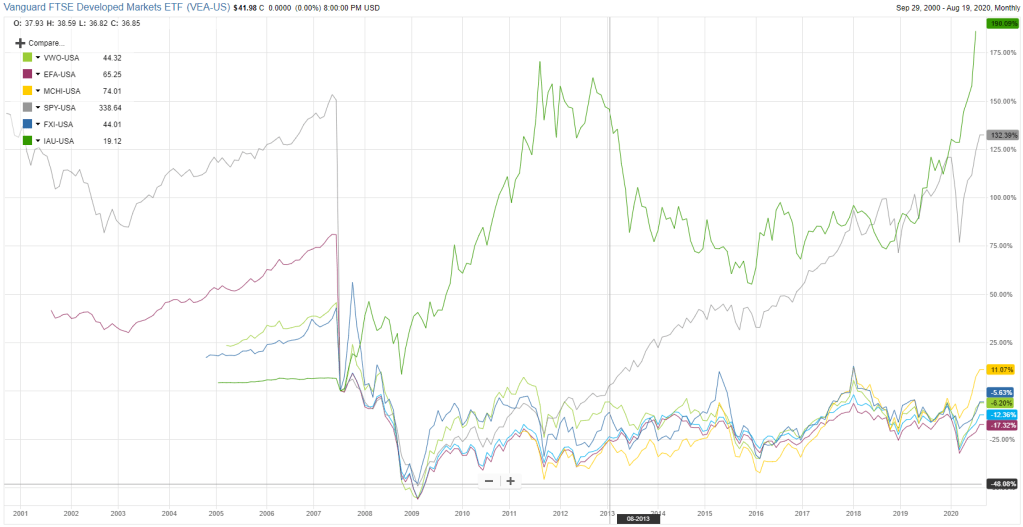

It was diversified on three aspects: international ETFs, weighting more on Chinese stocks and then Gold allocation.

Global: VEA, VWO, EFA; China: MCHI, FXI; and Gold: IAU

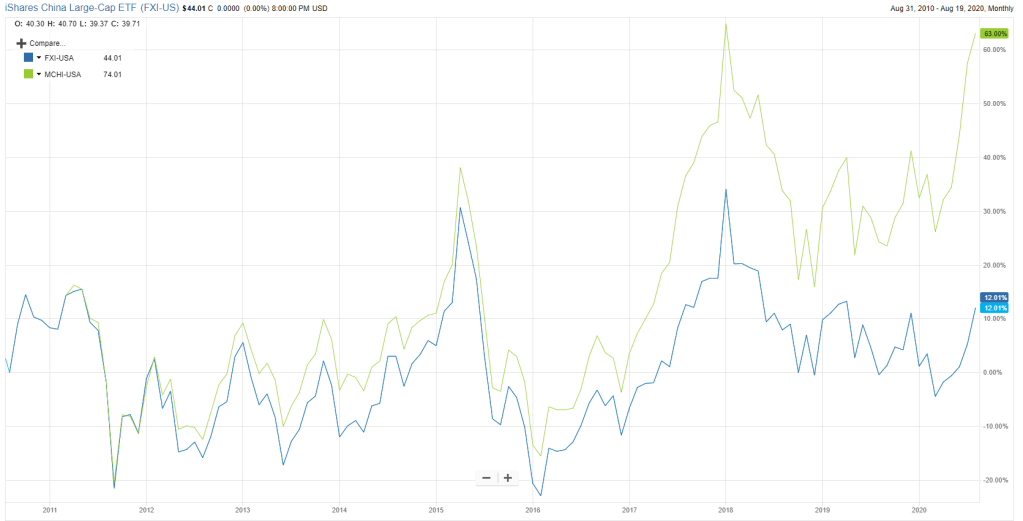

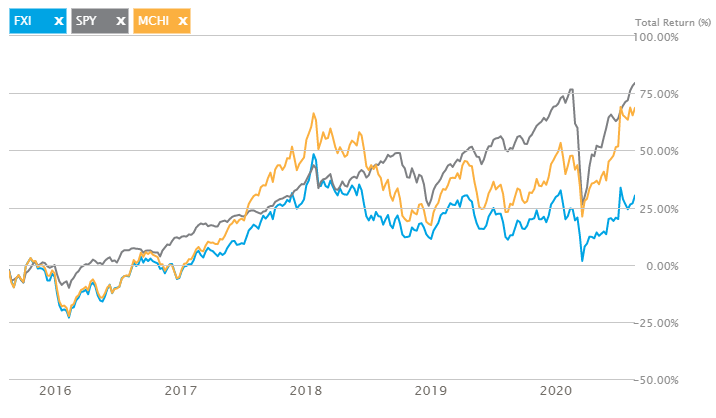

Zooming in on the two Chinese ETFs – MSCHI and large cap FXI, the last 10 years when GDP has been shooting up like crazy, the stock’s performance is mind-bogglingly lack luster:

How to make sense of it that there are a great number of companies joined the pool over last ten years? Does that mean the capital come in for the newly listed stocks, while the average price keeps even? It looks like a planned economy.

Apparently, companies such as Alibaba, Tencent, Maotao did rise up significantly, so that means the rest perform much worse, dragging down the overall level? It sure is a risky playground for investors.

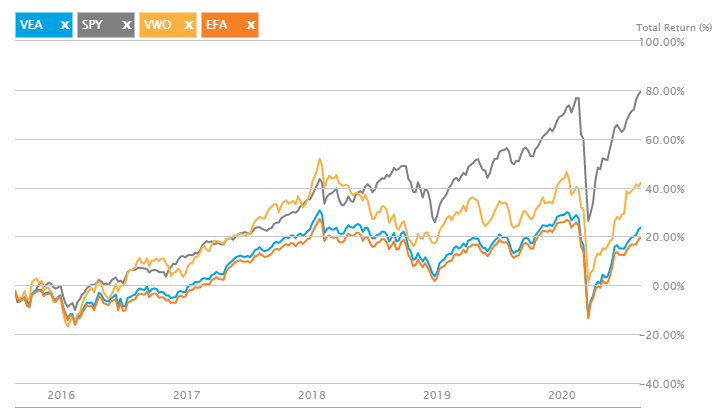

Past performance cannot predict the future, however, looking at Ray Dalio’s deployment into VEA, VWO, and EFA, all of which fall far behind the US marekt, represented by SPY, I have to conclude that Ray bet big on the reshuffling of current landscape.

The past performance is not indicator of the future, in this case, it will be quite a different picture.