Under the category of REITs, there are subcategories:

'Retail Equity REITs', 'Multi-Type Equity REITs', 'Office Equity REITs', 'Land Equity REITs', 'Hotel and Motel Equity REITs', 'Commercial Mortgage REITs', 'Apartment Equity REITs', 'Industrial and Warehouse Equity REITs', 'Healthcare and Life Sciences Equity REITs', 'Residential Mortgage REITs', 'Self-Storage Equity REITs', 'Student and Specialty Housing Equity REITs', 'Multi-Type Mortgage REITs', 'Manufactured Homes Equity REITs', 'Diversified REITs'

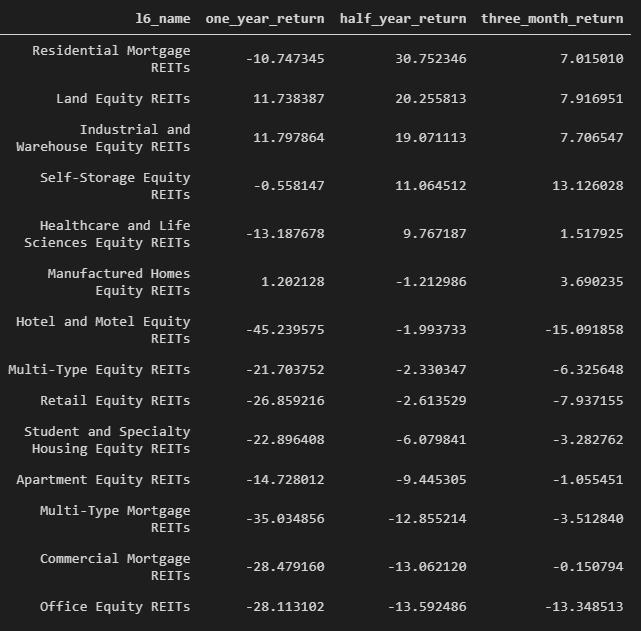

Before I apply any of my own speculation, I’d like to take a look at their past one year, half a year, and three-month performance to get the feeling of COVID impact:

Standing at today (9/14/2020), I sorted the return since the crashing day (3/14/2020)

One can see that residential mortgage REITs bounced back most, however, it’s still lower than last year at same date time. While Land Equity even rose up 11% compared to last year, and gained another ~9% increase since March meltdown, so is Industrial and Warehouse Equity REITs.

The rest – Healtcare and Life Science equity, Manufactured Homes Equity, Hotel and Motel Equity, Multi-Type Equity, Retail Equity, Student and Specialty Housing Equity, Apartment Equity, Multi-Type Mortgage, Commercial Mortgage and Office Equity are still in dire situation. The trend for Office Equity and Hotel Motel Equity REITs are particularly bad. Apartment REITs seems to reach to a halt in the last three month. So I could seriously consider getting in now leveraging that they are still at low.

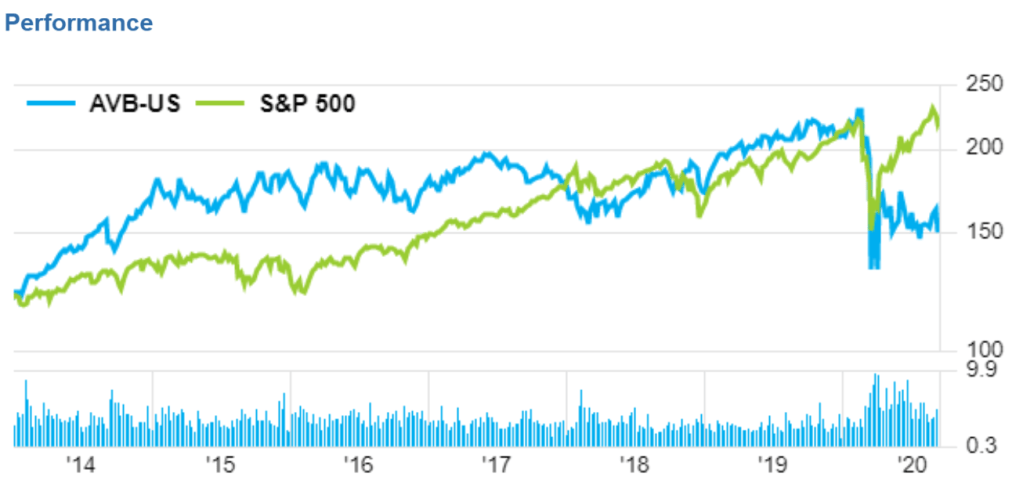

AVB-US Avalonbay Communities is down a lot, tumbled from 232 to 132 in the middle of march this year, then it fluctuates around $150 per share.

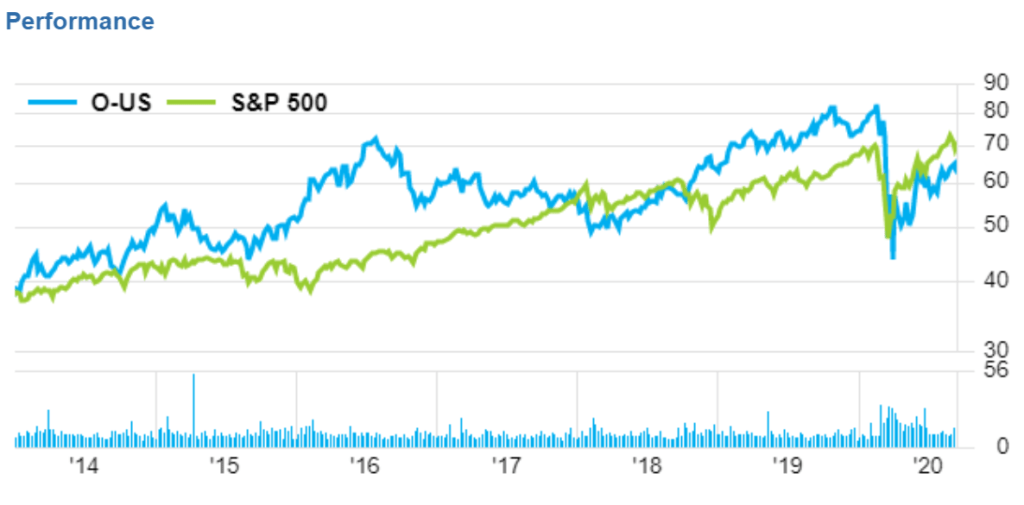

Retail REITs overall better off than Apartment REITs due to it’s mixed tenants. Some grocery retailer tenants are doing better than the rest. Hence company such as O-US Realty Income Operation bounce back more than AVB.

What’s worth noting is the Land Equity and Industrial and Warehouse Equity, both went up about 10% year-to-year during this abysmal period, reflecting the great expectation on tech booming that people are throwing more capital on communication and online store infrastructure buildings.

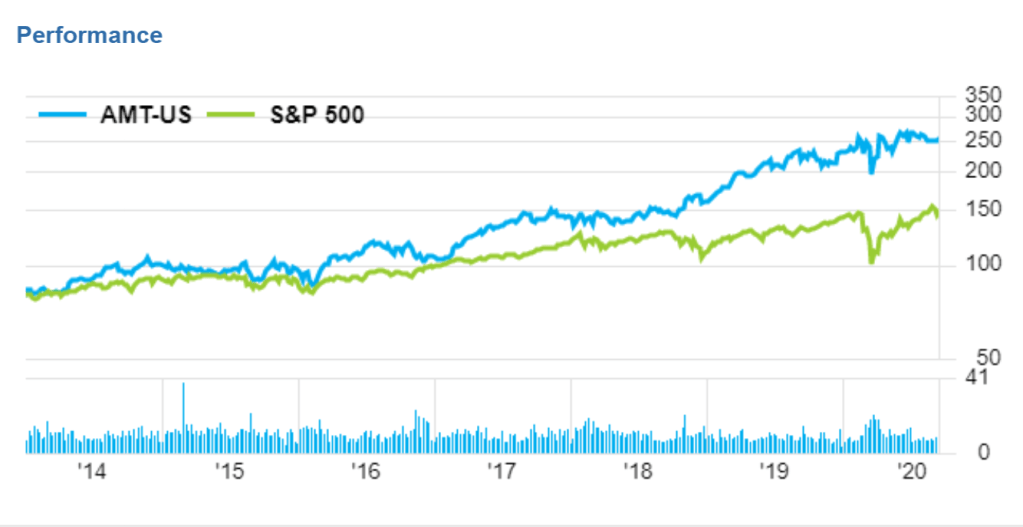

For example AMT-US American Tower Corporation, the performance has been up all the way:

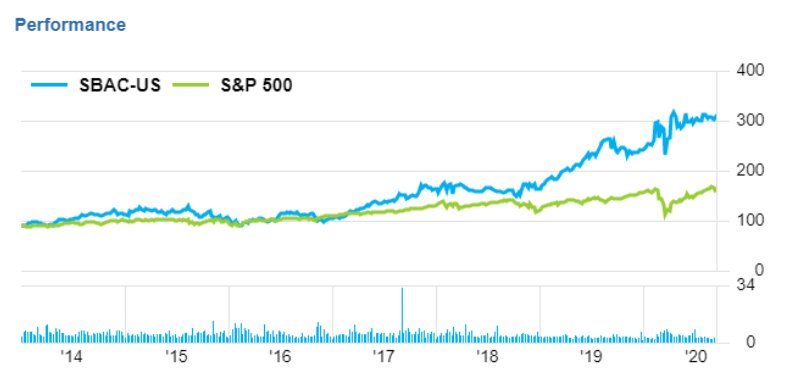

So is SBA Communication Corp(SBA-US)

LAND-US and UNIT-US seems to have biggest year to year return but the last 6 years its performance under SBA and AMT. In terms of market cap, the former AMT, SBAC together with Avalon is above $20B, while LAND and UNIT is much smaller, 0.3 and 1.8 billion only, too risky.

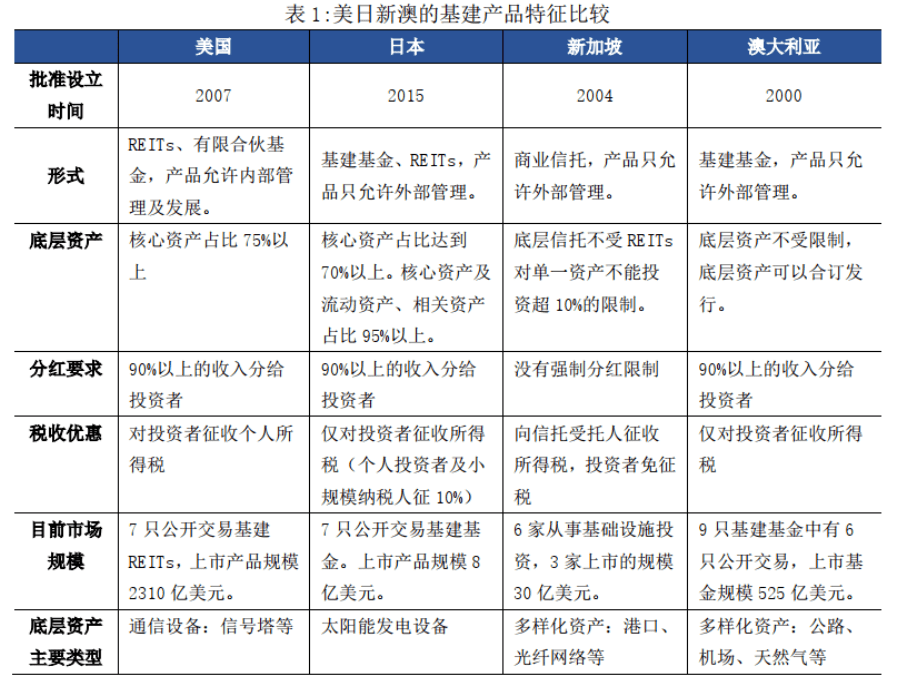

China is nor considering Land REITs to help mitigate capital pressure all on the shoulder of the government:

The boat already sailed off, but is there opportunities in China? Maybe yes, but risk is unfathomable.