Method and Results:

In this paper we are going to construct four themes – hydrogen, water, clean energy, and ocean sustainability- using LSA.

First, use Russell 3000 base universe and go through all databases to find available documents within last 9 months that have keyword "hydrogen", controlling the length of target text to be of ideal number of words. There are 2786 records generated from a wide array of document sources including 'MCT', 'DJNS', 'BW', 'FCIS', 'SA', 'BAML', 'GNW', 'AWF', 'EDG', 'DJBT', 'DGAP', 'PRN', 'DJCM', 'TWTR', 'SDR', 'FBLK', 'EDGSEC', 'FT', 'FCST', 'DJCS', 'MTNA', 'DJPR', 'PRNE', 'FCSTEV', 'RSDAM', 'DJES', 'DJGQ', 'FFR', 'WSJ', 'CRN', 'PRNA', 'TDN', 'AWP', 'ASX', 'MTEMEA', 'BRF', 'ACW', 'AFP', 'IA', 'ECMT', 'FSWA', 'SW', 'FFW', 'AFPE', 'RJ', 'DJIN', 'OMX', 'CNW', 'RF', 'FINW', 'FGP', 'AWG', 'PNCV', 'NAR'.

Take the first document for example, “‘particular has seemed to be focused on electric and hydrogen technology. Boeing, on the other hand, have recently that the use of electric or hybrid technology or hydrogen technology in the mainline aircraft, the bread’

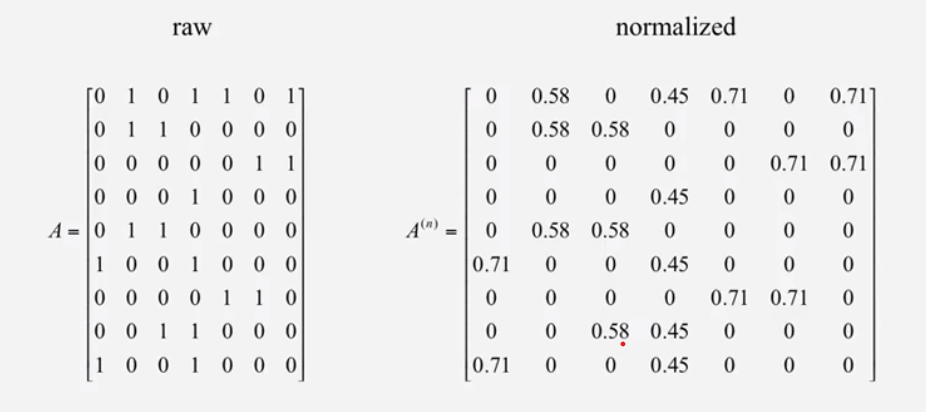

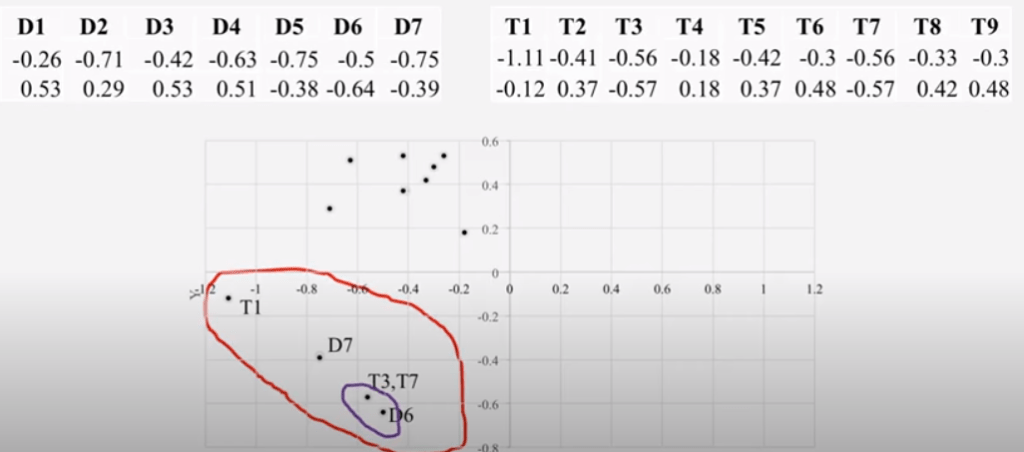

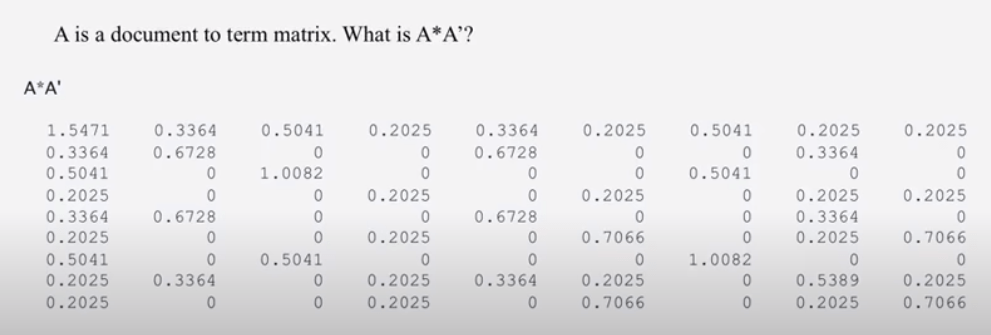

A is the document to term/word matrix, A*At is the word/term to term matrix;

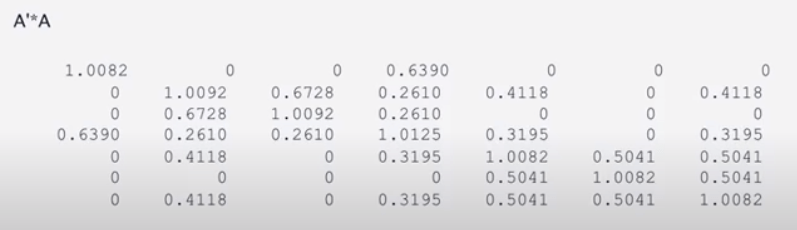

while At*A is the document to document matrix

And this is the word/term matrix

After cleansing it removing repetitive stop words, this text is converted to ‘particular seemed focused electric hydrogen technology boeing hand recentlythat use electric hybrid technology hydrogen technology mainline aircraft bread’.

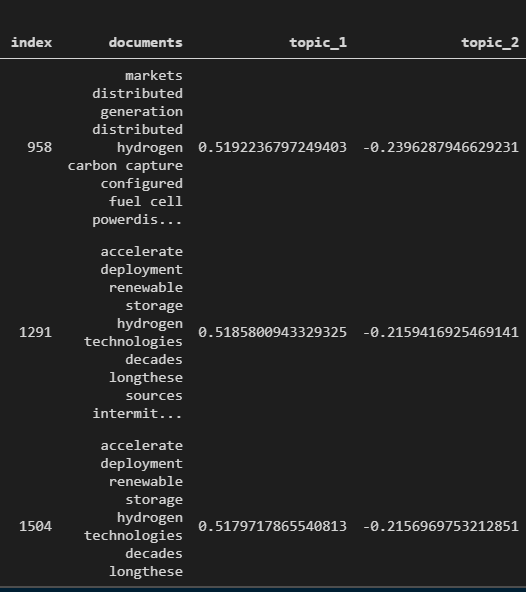

After vectorizing the corpora of these documents, we formed a large-scale matrix with a shape of (2786, 12527). After applying the SVD computation, we set the parameter to be top 3 topics/features,

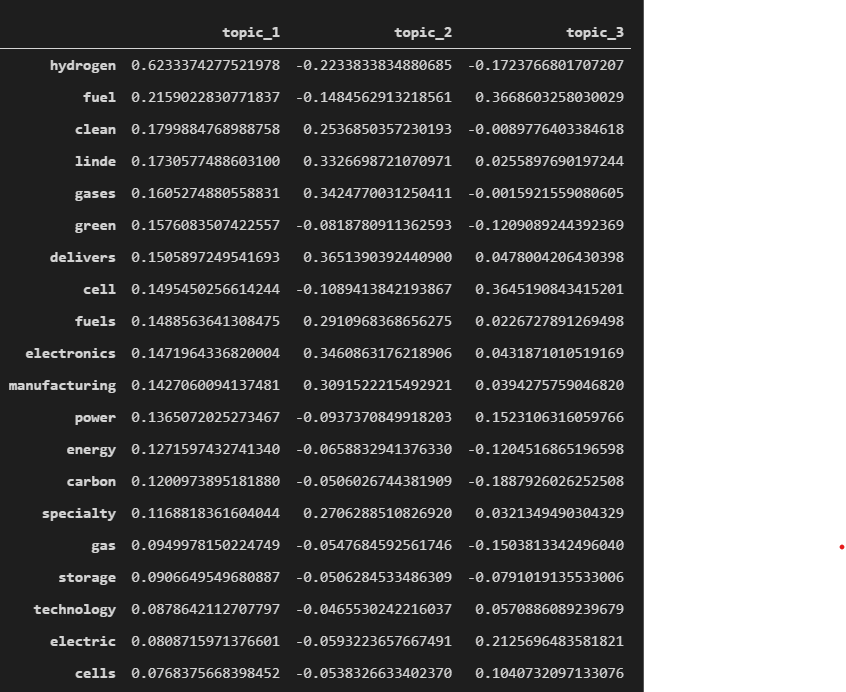

Further, to know what this top topic or feature is

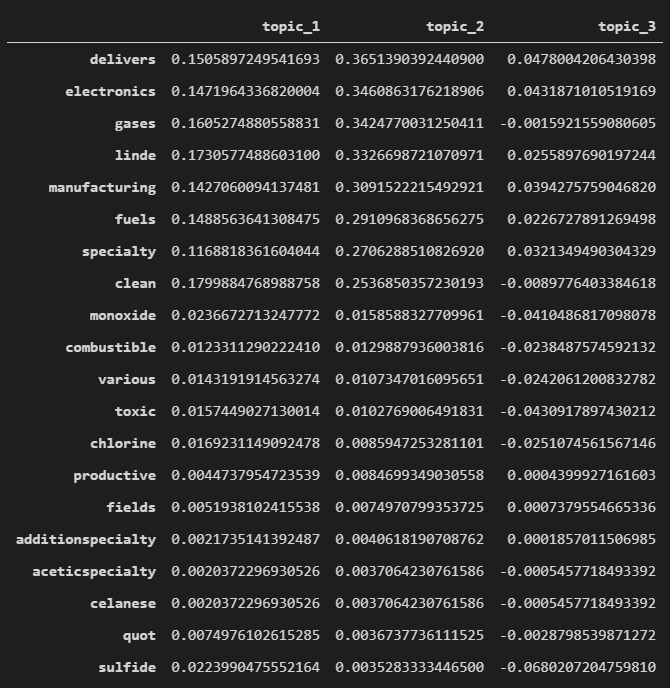

While topic 2 are composed of different set of words:

Now we have the ranking of every document, which is associated to a company, next, we need to identify the most relevant company accordingly. Since some documents are related to multiple stocks/companies, we remove them only keep document pointing to single stock. Additionally, we found FCST (transcript database) brought back the most number of documents(250), so we filter only FCST sourced documents for each company, take average of their topic score, keep those with topic1 score is equal or greater than the (mean-standard deviation) value, we obtained a US hydrogen portfolio (market cap >= $300m):

| Id | Date | p_symbol | p_symbol.1 | p_symbol.2 | ff_co_name | p_market_val_sec | p_exchange | adtv | topic_1 |

| PLUG-US | 2/22/2021 | US72919P2020 | 2508386 | PLUG-US | Plug Power, Inc. | 28085.7 | NAS | 1851 | 0.478346 |

| FCEL-US | 2/22/2021 | US35952H6018 | BK6S6J8 | FCEL-US | FuelCell Energy, Inc. | 6519.221 | NAS | 790.9532 | 0.475276 |

| APD-US | 2/22/2021 | US0091581068 | 2011602 | APD-US | Air Products & Chemicals, Inc. | 58390.55 | NYS | 329.0846 | 0.413747 |

| BE-US | 2/22/2021 | US0937121079 | BDD1BB8 | BE-US | Bloom Energy Corp. | 4431.369 | NYS | 162.7563 | 0.394135 |

| NJR-US | 2/22/2021 | US6460251068 | 2630513 | NJR-US | New Jersey Resources Corp. | 3811.517 | NYS | 19.25094 | 0.374612 |

| GTLS-US | 2/22/2021 | US16115Q3083 | B19HNF4 | GTLS-US | Chart Industries, Inc. | 4832.831 | NYS | 44.40889 | 0.36377 |

| ATI-US | 2/22/2021 | US01741R1023 | 2526117 | ATI-US | Allegheny Technologies, Inc. | 2457.702 | NYS | 26.81174 | 0.352432 |

| LIN-US | 2/22/2021 | IE00BZ12WP82 | BZ12WP8 | LIN-US | Linde Plc | 131676.1 | NYS | 412.1747 | 0.348215 |

| DUK-US | 2/22/2021 | US26441C2044 | B7VD3F2 | DUK-US | Duke Energy Corp. | 68002.67 | NYS | 247.3141 | 0.331449 |

| PCAR-US | 2/22/2021 | US6937181088 | 2665861 | PCAR-US | PACCAR, Inc. | 33024.91 | NAS | 147.4911 | 0.319731 |

| LXFR-US | 2/22/2021 | GB00BNK03D49 | BF5GRT5 | LXFR-US | Luxfer Holdings Plc | 515.4283 | NYS | 1.548303 | 0.314576 |

| BKR-US | 2/22/2021 | US05722G1004 | BDHLTQ5 | BKR-US | Baker Hughes Co. | 16048.12 | NYS | 126.2361 | 0.299677 |

| WMB-US | 2/22/2021 | US9694571004 | 2967181 | WMB-US | The Williams Cos., Inc. | 27475.58 | NYS | 184.6594 | 0.279647 |

| CMI-US | 2/22/2021 | US2310211063 | 2240202 | CMI-US | Cummins, Inc. | 36522.11 | NYS | 242.0975 | 0.279477 |

| SRE-US | 2/22/2021 | US8168511090 | 2138158 | SRE-US | Sempra Energy | 37651.45 | NYS | 190.3979 | 0.278915 |

| NEE-US | 2/22/2021 | US65339F1012 | 2328915 | NEE-US | NextEra Energy, Inc. | 153066.2 | NYS | 554.4232 | 0.277359 |

| CF-US | 2/22/2021 | US1252691001 | B0G4K50 | CF-US | CF Industries Holdings, Inc. | 9792.64 | NYS | 90.93523 | 0.276364 |

| KBR-US | 2/22/2021 | US48242W1062 | B1HHB18 | KBR-US | KBR, Inc. | 4597.922 | NYS | 33.57774 | 0.265426 |

| WEC-US | 2/22/2021 | US92939U1060 | BYY8XK8 | WEC-US | WEC Energy Group, Inc. | 26253.62 | NYS | 110.1452 | 0.264127 |

| EMR-US | 2/22/2021 | US2910111044 | 2313405 | EMR-US | Emerson Electric Co. | 51272.54 | NYS | 203.0424 | 0.263428 |

| AGR-US | 2/22/2021 | US05351W1036 | BYP0CD9 | AGR-US | Avangrid, Inc. | 13930.19 | NYS | 27.29743 | 0.255663 |

| MTRX-US | 2/22/2021 | US5768531056 | 2572068 | MTRX-US | Matrix Service Co. | 346.2235 | NAS | 2.937673 | 0.255432 |

| RUSHA-US | 2/22/2021 | US7818462092 | 2966876 | RUSHA-US | Rush Enterprises, Inc. | 1750.737 | NAS | 8.177229 | 0.252914 |

| KMI-US | 2/22/2021 | US49456B1017 | B3NQ4P8 | KMI-US | Kinder Morgan, Inc. | 33866.36 | NYS | 245.7693 | 0.24455 |

| OGS-US | 2/22/2021 | US68235P1084 | BJ0KXV4 | OGS-US | ONE Gas, Inc. | 3932.356 | NYS | 18.44767 | 0.240674 |

| PSX-US | 2/22/2021 | US7185461040 | B78C4Y8 | PSX-US | Phillips 66 | 35953.02 | NYS | 205.9026 | 0.238571 |

| DAN-US | 2/22/2021 | US2358252052 | B2PFJR3 | DAN-US | Dana, Inc. | 3223.261 | NYS | 26.26979 | 0.238432 |

| DOV-US | 2/22/2021 | US2600031080 | 2278407 | DOV-US | Dover Corp. | 17561.12 | NYS | 85.92194 | 0.217643 |

| BEPC-US | 2/22/2021 | CA11284V1058 | BMW8YT2 | BEPC-US | Brookfield Renewable Corp. | 8469.609 | NYS | 44.28724 | 0.217028 |

| XOM-US | 2/22/2021 | US30231G1022 | 2326618 | XOM-US | Exxon Mobil Corp. | 221682.2 | NYS | 1212.771 | 0.216212 |

| SLB-US | 2/22/2021 | AN8068571086 | 2779201 | SLB-US | Schlumberger NV | 36367.56 | NYS | 281.7826 | 0.215069 |

| AZPN-US | 2/22/2021 | US0453271035 | 2051868 | AZPN-US | Aspen Technology, Inc. | 10537.36 | NAS | 51.47538 | 0.21272 |

| TSLA-US | 2/22/2021 | US88160R1014 | B616C79 | TSLA-US | Tesla, Inc. | 749933.5 | NAS | 26729.57 | 0.207524 |

| HY-US | 2/22/2021 | US4491721050 | B7LG306 | HY-US | Hyster-Yale Materials Handling, Inc. | 1246.51 | NYS | 5.977456 | 0.207209 |

| NFG-US | 2/22/2021 | US6361801011 | 2626103 | NFG-US | National Fuel Gas Co. | 4144.29 | NYS | 18.88197 | 0.199536 |

| LAZ-US | 2/22/2021 | BMG540501027 | B081VQ7 | LAZ-US | Lazard Ltd. | 4641.453 | NYS | 27.89917 | 0.199406 |

| ATO-US | 2/22/2021 | US0495601058 | 2315359 | ATO-US | Atmos Energy Corp. | 11990.71 | NYS | 90.41402 | 0.195311 |

| J-US | 2/22/2021 | US4698141078 | 2469052 | J-US | Jacobs Engineering Group, Inc. | 14622.99 | NYS | 67.32813 | 0.194618 |

| SJI-US | 2/22/2021 | US8385181081 | 2825933 | SJI-US | South Jersey Industries, Inc. | 2440.321 | NYS | 19.19488 | 0.190869 |

| CC-US | 2/22/2021 | US1638511089 | BZ0CTP8 | CC-US | The Chemours Co. | 4286.212 | NYS | 29.73314 | 0.189885 |

| CAT-US | 2/22/2021 | US1491231015 | 2180201 | CAT-US | Caterpillar, Inc. | 114464.7 | NYS | 510.4117 | 0.188521 |

| CMS-US | 2/22/2021 | US1258961002 | 2219224 | CMS-US | CMS Energy Corp. | 16175.05 | NYS | 99.26598 | 0.186496 |

| OKE-US | 2/22/2021 | US6826801036 | 2130109 | OKE-US | ONEOK, Inc. | 20362.29 | NYS | 119.0931 | 0.186074 |

| VLO-US | 2/22/2021 | US91913Y1001 | 2041364 | VLO-US | Valero Energy Corp. | 29169.16 | NYS | 224.5973 | 0.185284 |

| XEL-US | 2/22/2021 | US98389B1008 | 2614807 | XEL-US | Xcel Energy, Inc. | 33371.86 | NAS | 154.8865 | 0.185053 |

| RTX-US | 2/22/2021 | US75513E1010 | BM5M5Y3 | RTX-US | Raytheon Technologies Corp. | 112836.4 | NYS | 459.6514 | 0.178425 |

| NWN-US | 2/22/2021 | US66765N1054 | BFNR303 | NWN-US | Northwest Natural Holding Co. | 1494.192 | NYS | 14.11395 | 0.178126 |

| ETR-US | 2/22/2021 | US29364G1031 | 2317087 | ETR-US | Entergy Corp. | 18657.67 | NYS | 128.1704 | 0.176371 |

| GM-US | 2/22/2021 | US37045V1008 | B665KZ5 | GM-US | General Motors Co. | 75748.79 | NYS | 991.4799 | 0.171622 |

| AMRC-US | 2/22/2021 | US02361E1082 | B3SWPT2 | AMRC-US | Ameresco, Inc. | 1919.791 | NYS | 22.21005 | 0.167686 |

| ETN-US | 2/22/2021 | IE00B8KQN827 | B8KQN82 | ETN-US | Eaton Corp. Plc | 50941.08 | NYS | 228.1494 | 0.162775 |

| HON-US | 2/22/2021 | US4385161066 | 2020459 | HON-US | Honeywell International, Inc. | 141576.2 | NYS | 518.0762 | 0.160773 |

| CNP-US | 2/22/2021 | US15189T1079 | 2440637 | CNP-US | CenterPoint Energy, Inc. | 11675.52 | NYS | 95.8031 | 0.158457 |

| ALSN-US | 2/22/2021 | US01973R1014 | B4PZ892 | ALSN-US | Allison Transmission Holdings, Inc. | 4269.581 | NYS | 37.74042 | 0.157128 |

| NOV-US | 2/22/2021 | US62955J1034 | BN2RYW9 | NOV-US | NOV, Inc. | 5446.604 | NYS | 70.77102 | 0.156641 |

| CVX-US | 2/22/2021 | US1667641005 | 2838555 | CVX-US | Chevron Corp. | 184420 | NYS | 856.6611 | 0.156143 |

| WAB-US | 2/22/2021 | US9297401088 | 2955733 | WAB-US | Westinghouse Air Brake Technologies Corp. | 13970.75 | NYS | 81.67142 | 0.155003 |

| BA-US | 2/22/2021 | US0970231058 | 2108601 | BA-US | The Boeing Co. | 126784.3 | NYS | 3091.603 | 0.154109 |

| NEM-US | 2/22/2021 | US6516391066 | 2636607 | NEM-US | Newmont Corp. | 45353.81 | NYS | 355.104 | 0.15371 |

| CMCO-US | 2/22/2021 | US1993331057 | 2211071 | CMCO-US | Columbus McKinnon Corp. | 1149.692 | NAS | 3.30757 | 0.153693 |

| LAD-US | 2/22/2021 | US5367971034 | 2515030 | LAD-US | Lithia Motors, Inc. | 10062.54 | NYS | 85.05016 | 0.151705 |

| IR-US | 2/22/2021 | US45687V1061 | BL5GZ82 | IR-US | Ingersoll Rand, Inc. | 18330.91 | NYS | 75.64819 | 0.149595 |

| FLT-US | 2/22/2021 | US3390411052 | B4R28B3 | FLT-US | FLEETCOR Technologies, Inc. | 22872.66 | NYS | 158.864 | 0.147923 |

| FLS-US | 2/22/2021 | US34354P1057 | 2288406 | FLS-US | Flowserve Corp. | 5111.537 | NYS | 28.42058 | 0.14479 |

| DCI-US | 2/22/2021 | US2576511099 | 2276467 | DCI-US | Donaldson Co., Inc. | 7705.685 | NYS | 26.48534 | 0.140336 |

| UGI-US | 2/22/2021 | US9026811052 | 2910118 | UGI-US | UGI Corp. | 8402.635 | NYS | 33.49469 | 0.139997 |

| GE-US | 2/22/2021 | US3696041033 | 2380498 | GE-US | General Electric Co. | 105390.7 | NYS | 821.6511 | 0.139869 |

| HAYN-US | 2/22/2021 | US4208772016 | B02WVH7 | HAYN-US | Haynes International, Inc. | 369.8114 | NAS | 2.684321 | 0.137949 |

| SR-US | 2/22/2021 | US84857L1017 | BYXJQG9 | SR-US | Spire Inc. | 3496.14 | NYS | 19.32382 | 0.136633 |

| THR-US | 2/22/2021 | US88362T1034 | B3N6F00 | THR-US | Thermon Group Holdings, Inc. | 592.5712 | NYS | 2.325063 | 0.130383 |

| FLR-US | 2/22/2021 | US3434121022 | 2696838 | FLR-US | Fluor Corp. | 2434.373 | NYS | 31.81162 | 0.129712 |

| SNDR-US | 2/22/2021 | US80689H1023 | BYVN953 | SNDR-US | Schneider National, Inc. | 2210.975 | NYS | 12.60489 | 0.128699 |

| NI-US | 2/22/2021 | US65473P1057 | 2645409 | NI-US | NiSource, Inc. | 8950.076 | NYS | 60.86271 | 0.126539 |

| AES-US | 2/22/2021 | US00130H1059 | 2002479 | AES-US | The AES Corp. | 18829.86 | NYS | 144.5494 | 0.119861 |

| TPIC-US | 2/22/2021 | US87266J1043 | BYYGK12 | TPIC-US | TPI Composites, Inc. | 2519.726 | NAS | 41.5175 | 0.11437 |

| SO-US | 2/22/2021 | US8425871071 | 2829601 | SO-US | The Southern Co. | 62667.52 | NYS | 201.1552 | 0.114074 |

| ENS-US | 2/22/2021 | US29275Y1029 | B020GQ5 | ENS-US | EnerSys | 3898.603 | NYS | 19.74859 | 0.113874 |

| WERN-US | 2/22/2021 | US9507551086 | 2948852 | WERN-US | Werner Enterprises, Inc. | 2955.709 | NAS | 23.46665 | 0.108954 |

| ADM-US | 2/22/2021 | US0394831020 | 2047317 | ADM-US | Archer-Daniels-Midland Co. | 31338.2 | NYS | 117.7202 | 0.10666 |

| ASPN-US | 2/22/2021 | US04523Y1055 | BN65SM7 | ASPN-US | Aspen Aerogels, Inc. | 638.6505 | NYS | 4.75875 | 0.104615 |

| HASI-US | 2/22/2021 | US41068X1000 | B9HHD96 | HASI-US | Hannon Armstrong Sustainable Infrastructure Capital, Inc. | 4847.081 | NYS | 43.0033 | 0.10375 |

| PBF-US | 2/22/2021 | US69318G1067 | B7F4TJ7 | PBF-US | PBF Energy, Inc. | 1623.798 | NYS | 51.75431 | 0.103303 |

| GTES-US | 2/22/2021 | GB00BD9G2S12 | BD9G2S1 | GTES-US | Gates Industrial Corp. Plc | 4941.593 | NYS | 3.351595 | 0.101966 |

| EQIX-US | 2/22/2021 | US29444U7000 | BVLZX12 | EQIX-US | Equinix, Inc. | 60735.38 | NAS | 343.933 | 0.101727 |

| IDA-US | 2/22/2021 | US4511071064 | 2296937 | IDA-US | IDACORP, Inc. | 4450.377 | NYS | 27.23598 | 0.100936 |

| TT-US | 2/22/2021 | IE00BK9ZQ967 | BK9ZQ96 | TT-US | Trane Technologies Plc | 36708.48 | NYS | 173.7251 | 0.098733 |

| ACM-US | 2/22/2021 | US00766T1007 | B1VZ431 | ACM-US | AECOM | 8443.192 | NYS | 55.0099 | 0.09789 |

| REVG-US | 2/22/2021 | US7495271071 | BDRW1P1 | REVG-US | REV Group, Inc. | 784.92 | NYS | 2.723662 | 0.097737 |

| MDU-US | 2/22/2021 | US5526901096 | 2547323 | MDU-US | MDU Resources Group, Inc. | 5698.835 | NYS | 23.49703 | 0.097626 |

| SPGI-US | 2/22/2021 | US78409V1044 | BYV2325 | SPGI-US | S&P Global, Inc. | 81655.06 | NYS | 546.5309 | 0.097095 |

| PWR-US | 2/22/2021 | US74762E1029 | 2150204 | PWR-US | Quanta Services, Inc. | 10727.01 | NYS | 77.158 | 0.094897 |

| INFO-US | 2/22/2021 | BMG475671050 | BD0Q558 | INFO-US | IHS Markit Ltd. | 36962.36 | NYS | 285.4182 | 0.094232 |

| DOW-US | 2/22/2021 | US2605571031 | BHXCF84 | DOW-US | Dow, Inc. | 44925 | NYS | 206.1239 | 0.093536 |

| REGI-US | 2/22/2021 | US75972A3014 | B7577T2 | REGI-US | Renewable Energy Group, Inc. | 3813.307 | NAS | 84.50222 | 0.09342 |

| CVI-US | 2/22/2021 | US12662P1084 | B23PS12 | CVI-US | CVR Energy, Inc. | 2302.151 | NYS | 9.393456 | 0.091302 |

| WTRG-US | 2/22/2021 | US29670G1022 | BLCF3J9 | WTRG-US | Essential Utilities, Inc. | 11177.03 | NYS | 46.77527 | 0.091217 |

| CLF-US | 2/22/2021 | US1858991011 | BYVZ186 | CLF-US | Cleveland-Cliffs, Inc. | 8490.291 | NYS | 210.6924 | 0.090391 |

| WOR-US | 2/22/2021 | US9818111026 | 2981932 | WOR-US | Worthington Industries, Inc. | 3294.414 | NYS | 13.30405 | 0.090075 |

| MPC-US | 2/22/2021 | US56585A1025 | B3K3L40 | MPC-US | Marathon Petroleum Corp. | 34503 | NYS | 253.6227 | 0.08948 |

| VNT-US | 2/22/2021 | US9288811014 | BH4GV32 | VNT-US | Vontier Corp. | 5284.069 | NYS | 81.30291 | 0.088447 |

| MTZ-US | 2/22/2021 | US5763231090 | 2155306 | MTZ-US | MasTec, Inc. | 6343.693 | NYS | 52.90216 | 0.088215 |

| OLN-US | 2/22/2021 | US6806652052 | 2658526 | OLN-US | Olin Corp. | 4732.704 | NYS | 33.21598 | 0.086323 |

| MNR-US | 2/22/2021 | US6097201072 | 2504072 | MNR-US | Monmouth Real Estate Investment Corp. | 1758.598 | NYS | 9.651529 | 0.084795 |

Next, we’d try the same method on Korean stock market.