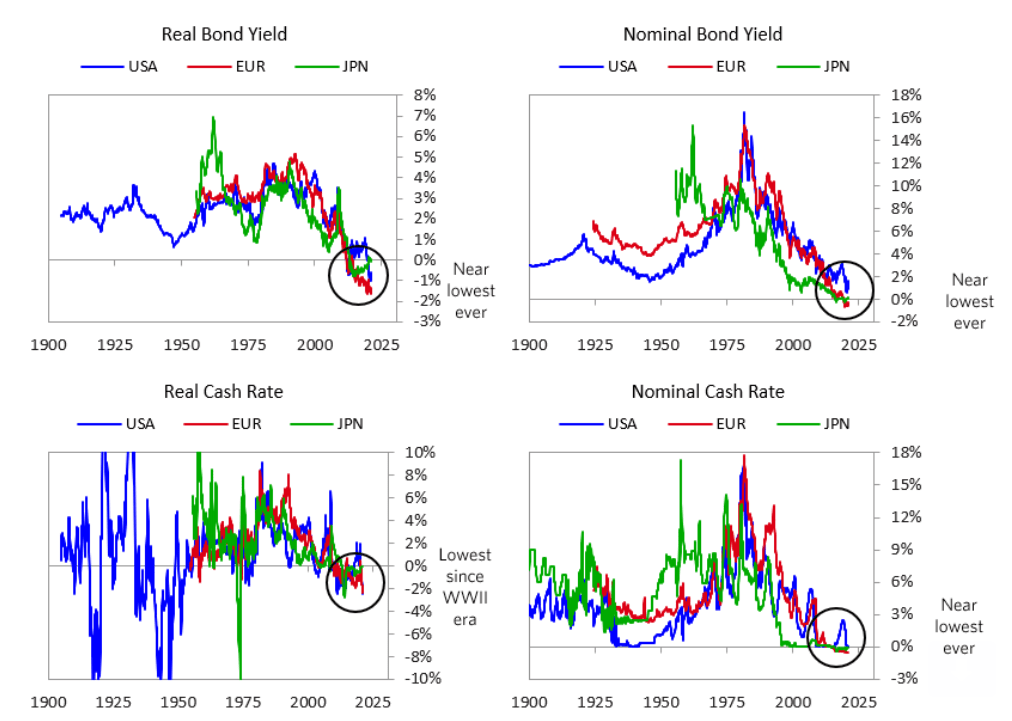

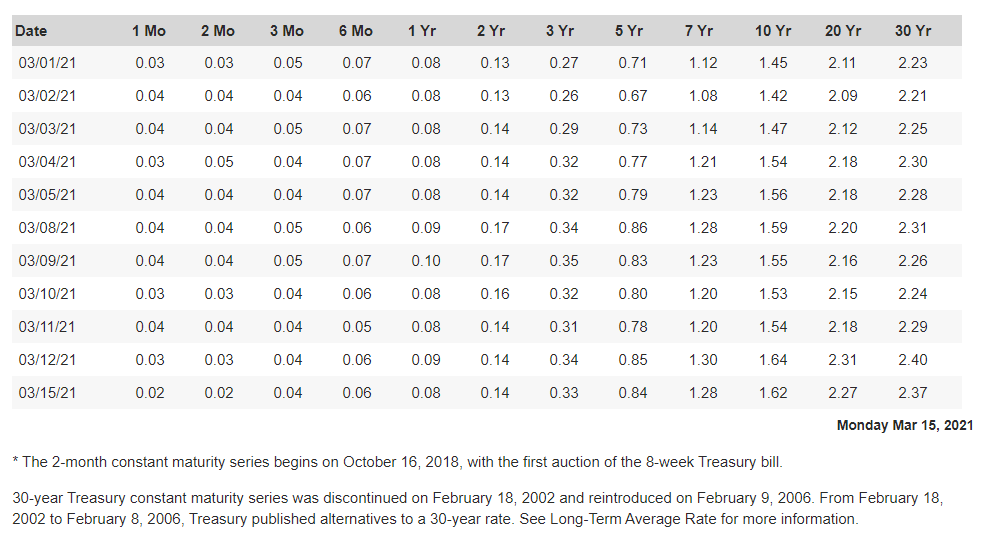

In his latest article (March 15, 2021), Ray Dalio starts with the apparent fact – “Bond markets offer ridiculously low yields.“, “pension funds, insurance companies, sovereign wealth funds, and savings accounts cannot meet their financial needs with these investments so holding bonds assures their failure to meet their obligations.”. This is particularly true for US bonds because of the “exorbitant privilege” that US dollar so far the world-wide reserve currency.

It doesn’t take much brain to foresee interest rate rise, bond price fall and “central banks will have to print substantial amounts of money to buy the debt assets that the free-market buyer won’t buy, which would be very reflationary (bearish for the dollar and the leading currencies who do this, relative to reflation assets?).”

There is now over $75 trillion of US debt assets of varying maturities. Ray Dalio said it’s been a way-to-long bull market of bond that the bond holders don’t feel the sting which is imminent. On the contrary, some jumped into the bond purchasing spree speculating that the nominal rate can turn negative, pushing bond price higher. But someday this will break, when debt holders started to sell, it will cause “run on banks”, or “bank squeezing”, even worse, once it started, there is “no stopping it. It has to be accommodated the way it was accommodated in the 1930-45 period and the 1970-80 period (and hundreds of similar periods throughout history) via printing a lot of money and devaluing it, and restructuring a lot of debt and government finances, usually including large increases in taxes.“

Ray Dalio continues the significant point herein “History and logic show that central banks, when faced with the supply/demand imbalance situation that would lead interest rates to rise to more than is desirable in light of economic circumstances, will print the money to buy bonds and create “yield curve controls” to put a cap on bond yields and will devalue cash.” He had experienced and pointed out that over the history, the Fed always interfere trying to keep the bond rate low, but cash return rate even lower, hence people naturally trying to flee either terrible choices by investing in gold, then the Fed ban/remove gold anchoring – “they might have to prevent the movement to other storehold of wealth assets and other countries”. It is happening right now – that’s why bitcoin went crazy high – $60,000 now.

This Dynamic Is Typical of the Late Stage of the Long-Term Debt Cycle, “Rather than being unusual, the dynamic I am describing has happened repeatedly throughout history.” – Ray Dalio. It’s a long term cycle signaled by 100 years, we’re at the end of it.

The debts are like nuclear waste that isn’t easy to dispose of. When it accumulate to unstainable zone, things could go abruptly traumatic, chaos, tax increase, conflicts even war could be possible.

“I’m just a practical global macro investor focusing on the mechanics and its implications trying to stay one step ahead of the crowd,” “Now, there’s just so much money injected into the markets and the economy that the markets are like a casino with people playing with funny money.”

Lastly and foremost importantly, what’s next?

“could very well impose prohibitions against capital movements to other assets (e.g., gold, Bitcoin, etc.) and other locations. These tax changes could be more shocking than expected. For example, Elizabeth Warren’s proposed wealth tax is of an unprecedented size that, based on my study of wealth taxes in other countries at other times, will most likely lead to more capital outflows and other moves to evade these taxes. The United States could become perceived as a place that is inhospitable to capitalism and capitalists. Though this specific wealth tax bill is unlikely to pass this year the chances of a sizable wealth tax bill passing over the next few years are significant. Conflicts can increase in such difficult times when accompanied by large wealth, values, and political gaps, and the environment can become inhospitable to capitalists leading them to run from less hospitable places to more hospitable places.”

So this is a new paradigm, “ For these reasons I believe a well-diversified portfolio of non-debt and non-dollar assets along with a short cash position is preferable to a traditional stock/bond mix that is heavily skewed to US dollars. I also believe that assets in the mature developed reserve currency countries will underperform the Asian (including Chinese) emerging countries’ markets. I also believe that one should be mindful of tax changes and the possibility of capital controls.“