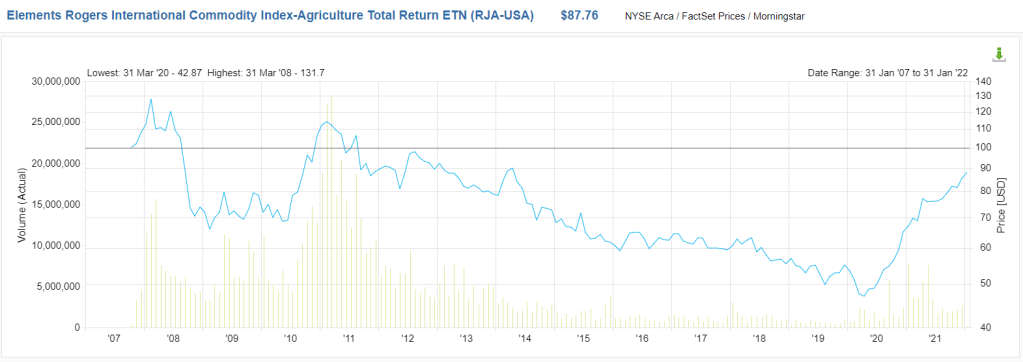

First, take a look at the price performance:

RJA tracks a consumption-based index of agricultural commodities chosen by the RICI committee. It is issued by the government of Sweden. It was launched in 2007, performance is lackluster until recent two years. The expense ratio is 0.75%. As of today (Jan 31, 2022), the AuM is $171M.

It represent the value of a basket of 21 agricultural futures contracts for RJA avoids K-1 distributions but carries the counterparty risk of its issuer. It invests solely in front-month futures contracts. This means that the fund will be particularly sensitive to changes in spot prices, but may be priced higher or lower than spot, sometimes dramatically. Rolling Strategy RJA rolls its underlying contracts over a 15 day period during the month preceding a given contract’s expiration.

Peer funds are DBA (DBA’s broadens its holdings to include livestock in its universe in exchange for under-weighting heavily produced commodities like corn and wheat, and chooses the contracts it holds based on the shape of the futures curve (in order to dampen contango effects). Specifically, the underlying index includes corn, soybeans, wheat, Kansas City wheat, sugar, cocoa, coffee, cotton, live cattle, feeder cattle, and lean hogs. Investors will therefore get less sensitivity to short-term spot movements, as well as exposure to different risk factors. The fund’s structure as a commodities pool means that holders will receive a K-1. The fund and the underlying index undergoes annual rebalance and reconstitution each November.), JJA (

Fund InsightJJA tracks an index of futures contracts on agricultural commodities. The notes targeted contracts include corn, soybeans, sugar, wheat, soybean oil, coffee, and cotton. The index eliminated cocoa futures from its basket in 2005. The methodology weights the contracts by liquidity (2/3) and US dollar-weighted production (1/3). Each commodity contract has a roll schedule that is set by the index provider, Bloomberg, and varies in length from one to five months to maturity. Investors avoid a K-1 at tax time due to the ETN wrapper, but also accept some counterparty risk from issuer Barclays. JJA replaced an older ETN with the same ticker. The newer, series B note tracks the same index and avoids path dependency issues. It also includes a call provision. The new version traded under the ticker JJAB until Nov. 16, 2018.)

Back in 2012, there were a bunch of pessimistic investors represented by Jim Rogers, singling bearish and inflationary market due to QE, see this short seeking-alpha article by Jared Cummans: “

As Bernanke and the Fed continue to print more money and debase the dollar, investors are becoming increasingly concerned with the potential impact this will have on inflation. This has led to many turning to commodity investments to help protect their portfolios. Among the most popular inflation hedge investments are agricultural commodities, as food prices are among the first to feel the effects of inflation.” This article is very informative in comparing DBA and RJA, however, in terms of timing, if you really put in money in either one back in 2012, the return is miserable.

With current inflationary environment, RJA or DBA still has some room to go up. I need to keep a close eye on it.

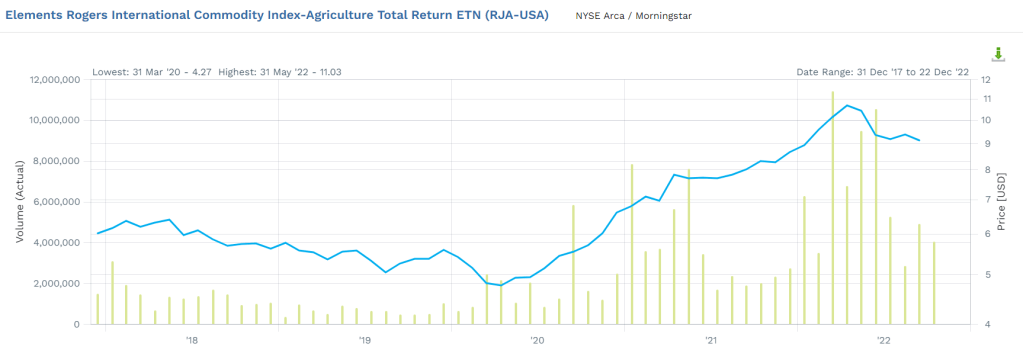

updating its performance on end of 2022:

So it does realize the long-lasting prediction by Jim Rogers by showing a upward slope since 2020, however, thanks to the continuous rate increasing by the Fed, it’s heading downward clearly by end of 2022.