If you hold a bullish view of a security or a whole market represented by an index fund like S&P 500 ETF SPY or Nasdaq stocks QQQ you want to buy this fund either SPY or QQQ. However, you are also very risk-averse, so there is a solution for this kind of investors called “covered call”. Basically you buy in the asset and concurrently also sell the call options of the underlying asset at a striking price. As a result, you benefit from the bullish performance (as you hold the view about) however, the upside is capped at the striking price you sell for, meanwhile, you also collect premiums from buyers who buy the call options. If it turns out to be performing worse and worse, you still make some money from premiums however, the premium amount become less and less and meanwhile the asset you hold also worth less and less. Overall, the premium of call option is majorly decided by the volatility, hence, the ideal condition to use such “covered call” strategy is when you hold bullish view but not 100% sure and the volatility is high. Particularly in an unstable political climate, covered call can be a good way to ride out riskier periods in the market while still bringing in a profit.

According to an Investopedia article, “KEY TAKEAWAYS

- According to a study commissioned by the CBOE, a strategy of buying the S&P 500 and selling at-the-money covered calls slightly outperformed the S&P 500.

- Partly due to the increase in returns when market volatility is high, a covered call approach is usually considerably less volatile than the market itself.

- A covered call ETF will also perform quite differently than the S&P 500 during particular years.

- Covered call ETFs make a relatively complicated and fairly profitable options market strategy easily accessible to average investors.”

It is particularly better investment product when there are both high bearish sentiment and volatility. However, once that period is over, investors of such kind shall be very cognizant of the loss of huge upside if in a strong bullish market and the risk of still losing money in a strong bearish market. Hence adjusting your investment strategy timely is always needed.

According to the above analysis of “covered calls”, it is great but hard for small investors to operate. Covered call ETF are now available for investors. This product simplifies the process for investors by hiring professional managers who leverage option trading to execute this strategy. In the following I listed covered call ETFs in market sourced from etf.com:

What’s worth noting is QYLD and KNG.

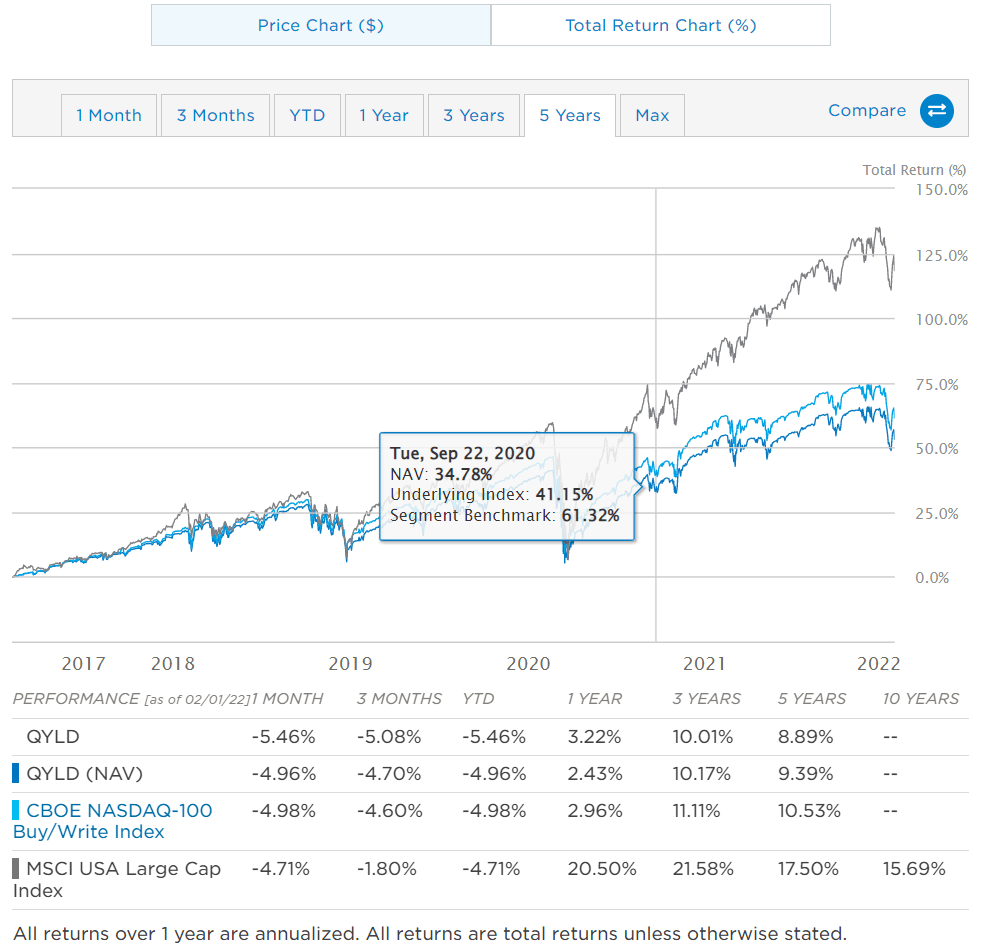

QYLD has $6.32B (as of Feb 2022) AuM. The description is as “QYLD seeks yield from the Nasdaq-100 via options premium. Historically, investors came to the Nasdaq for growth, not yield. While that dynamic may be shifting as tech giants mature and begin paying dividends, the fact remains that pure-play S&P 500 funds offer more yield than the ‘plain vanilla’ Nasdaq-100 fund QQQ. Enter QYLD, which matches QQQ’s Nasdaq-100 exposure, but earns income by selling call options and passes it on to investors net of fees. Covered call ETFs are hardly new, but QYLD was the first to apply it to the Nasdaq-100. Expect a generally less volatile return pattern from QYLD relative to QQQ. Use great care trading and monitor the asset levels. Also note that the fund’s prospectus allows a bit of leverage.” There is also tax benefits claimed by its manager Molchan. The expense ratio is 0.6%.

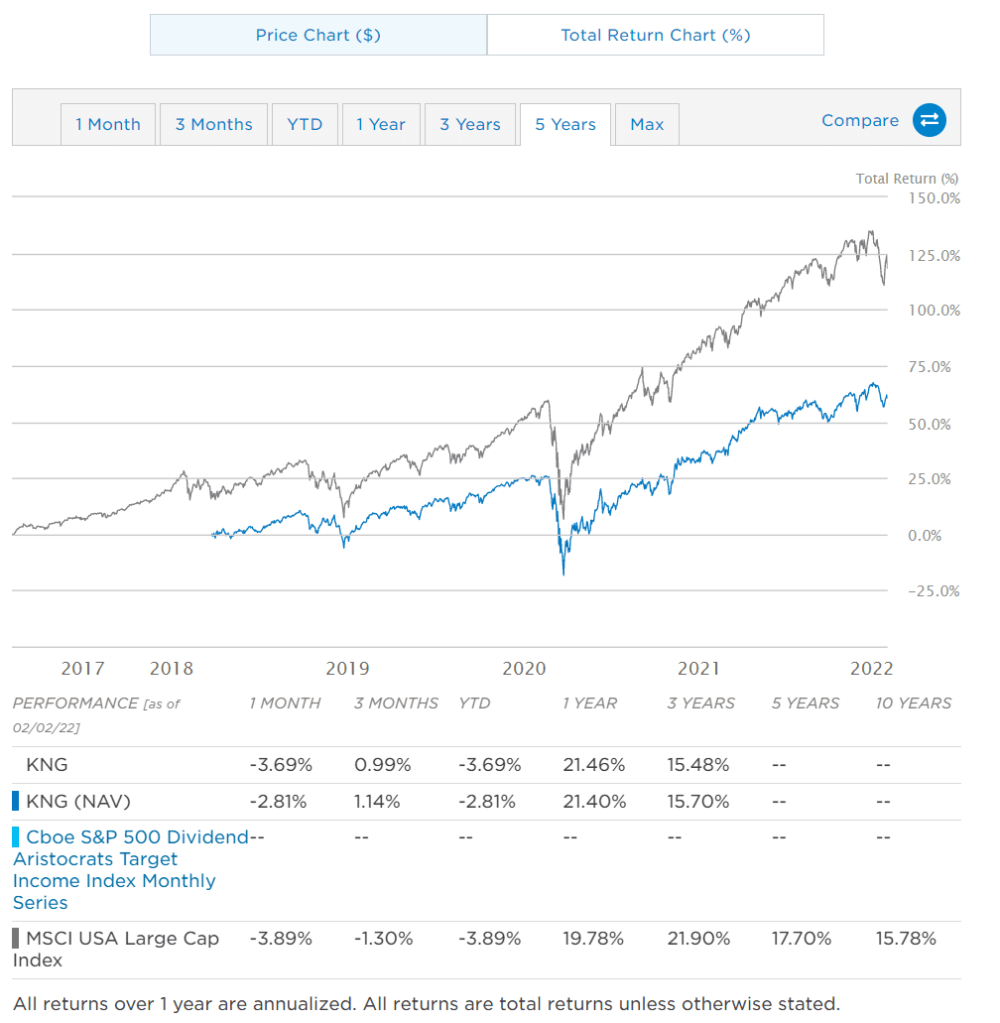

QYLD was launched 2013 by Issuer Mirae Asset Global Investments Co., Ltd , five years later in 2018, KNG was issued by First Trust. according to etf.com description, “KNG employs an adjusted buy-write strategy on a dividend-focused portfolio. The equal-weighted portfolio is made up of companies from the S&P 500 that have increased dividends for each of the last 25 years. The fund writes covered call options on these stocks, which generates additional income but limits the upside of the portfolio. Rather than writing calls on the entire notional value of the fund’s stock holdings, KNG aims for combined income from dividends and call options that is 3% higher than the yield on the S&P 500. The covered call overlay is limited to 20% of the notional value. The index is reconstituted annually and rebalanced quarterly. Prior to being acquired by First Trust on March 1, 2021, the fund was managed by Cboe Vest Financial.”

KNG’s expense ratio is slightly higher 0.75% compared to QYLD’s 0.60%. And its AuM is significantly smaller at around$400M. Considering liquidity it’s suboptimal.

In the latest three months, both returns negative in terms of total returns because it’s not the bearish sentiment but bearish is a fact now.

When “covered call ETF” get the biggest hit? When the underlying asset/market dropped drastically and then recovered drastically too. Because you get all of the drop – selling premium won’t be able to off set, but if the recovery is too fast you give up the significant upside. The managers just can’t keep up with the crazy fluctuation at that moment. March 2020 when the pandemic lockdown just started is a great example.

People argue this strategy is not as good as directly investing in SPY or QQQ. In the long run, it seems totally true. Except that this strategy is suitable only to a special group of people, people who count on fixed-income generating for their retirement. There is a very insightful comment in Quora: “it pays distributions monthly, which tend average about 1% of NAV, or 10–12% annually. This would seem to compare favorably to an index ETF like SPY, which on a life-of-fund basis is just over 10%. SPY pays quarterly distributions, which are just under 2% annually.”

However, QYLD’s NAV has a long-term downtrend: