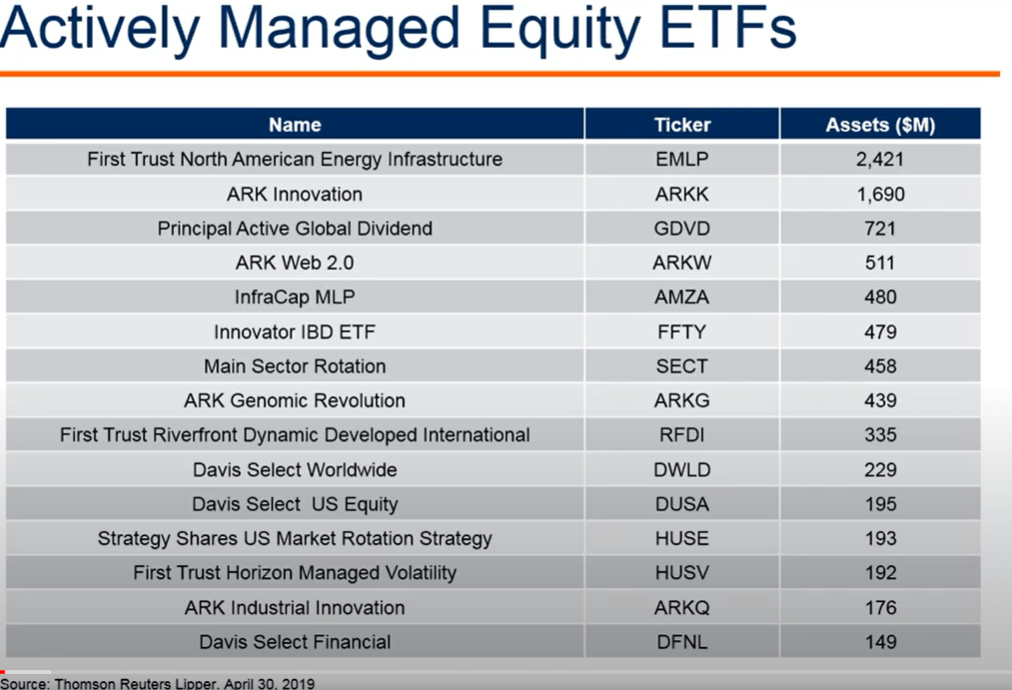

What is active ETFs? there isn’t an index behind, ETF is just a wrapper.

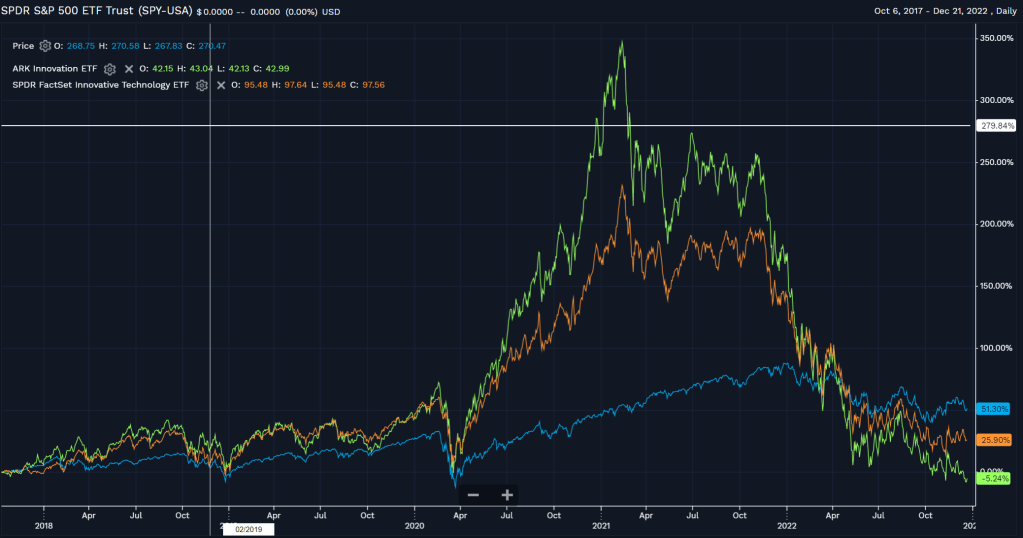

The famous one is run by ARK, here listed are ARKK, ARKW, ARKG and ARKQ. Take a look at the spectacular performance of ARKK:

As to the description of ARKK, “ARKK is full of cutting-edge firms, selected to represent the advisers highest-conviction investment ideas in this space. The adviser defines disruptive innovation as a technologically enabled new product or service that has the potential to change the way the world works. ARKK’s portfolio focuses on companies involved in genomics, automation, transportation, energy, artificial intelligence and materials, shared technology, infrastructure and services , and technologies that make financial services more efficient . ARKK’s proprietary macroeconomic and fundamental research, aimed at assessing company potential,drives security selection and weighting. ARKK’s research integrates ESG considerations as a secondary assessment.”

DWLD:

DWLD curates a concentrated portfolio of global stocks of all capitalization, from both developed and emerging markets. The funds active management takes a bottom-up approach to the global equity market, emphasizing individual security selection and focusing particularly on the quality of a companys management, business model, and competitive advantages. The fund manager aims to purchase securities at a discount to intrinsic value, ideally holding these positions for at least five years. Generally, DWLD will include equity securities from at least three countries and will invest at least 30% of the portfolio outside the US. DWLD launched in January 2017 from issuer Davis, an established asset manager that is new to ETFs.

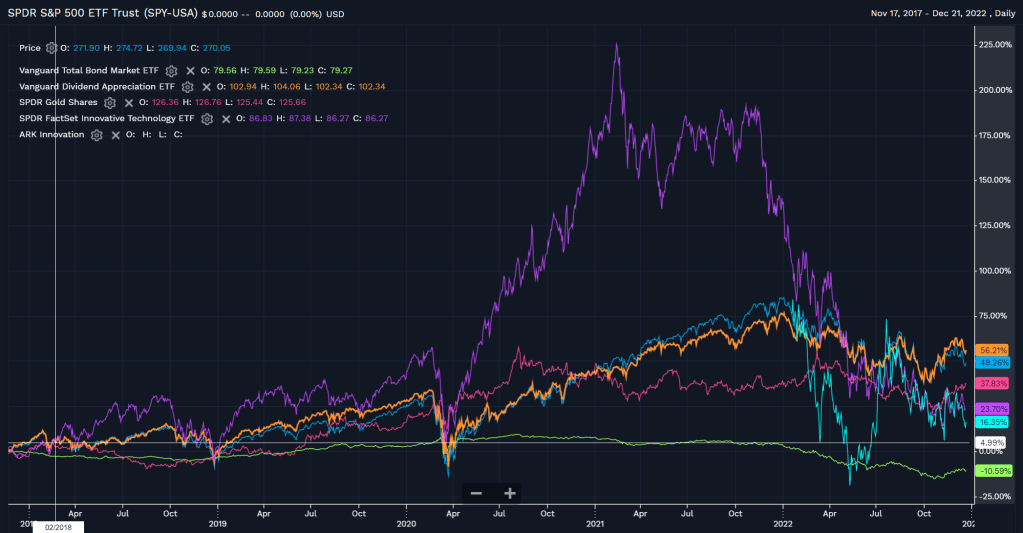

Compare to the benchmark like juggernaut ETFs:

We can conclude, to make big bucks XITK kind of instrument is the one. 2021 is extraordinary volatile for tech companies. Bonds are mediocre ways to gain.

Highlight the great profit from innovative technology compared to SPY: