The STF Tactical Growth ETF (TUG) is an exchange-traded fund that mostly invests in target outcome asset allocation. The fund seeks long-term capital growth by allocating its exposure to US equity and fixed income securities based on proprietary signals. The fund is actively managed TUG was launched on May 19, 2022 and is managed by STF. The strategy rotates between equity exposure through the Nasdaq-100 and fixed income using US Treasury bonds and bills based on proprietary signals. They are actively managed.

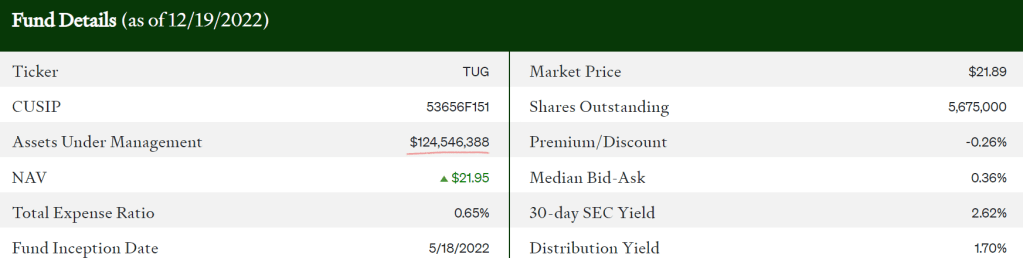

It was just launched over half a year ago, already has accumulated $124 Million AuM.

It won’t be possible to harvest this much AuM without big brains behind.

Jonathan Molchan serves as a Managing Partner of STF Management LP. He began his career at SAC Capital Advisors where he focused on long/short equity as well as listed and OTC quantitative derivatives’ strategies. Following that, while at Millennium Management, he focused on long/short equity, global macro, and derivatives’ trading, research, and risk management. He has also held roles at Cowen and Mirae Asset.. He became involved in the ETF industry in 2013 as he saw an opportunity to utilize his derivatives’ experience to expand options-based ETFs to the investment community. Throughout his time focused on ETFs, he has served in numerous role to include, portfolio manager, product developer and manager, and a marketer of options-based strategies; in addition to being featured in numerous industry outlets with a focus on education revolving around options and asset allocation.

Thomas Campbell serves as a Managing Partner of STF Management LP and began his career in financial services with Fidelity Investments in the early 1990s, focused on retail marketing efforts. Becoming an independent representative and advisor in 1995, by 1998 he was a branch manager for his firm, and in 1999 completed his CFP designation (since released). He caught the active management bug prior to 2001 and ever since has focused on tactical approaches to asset allocation. By 2008, these efforts culminated in the creation of the rule set for Self-adjusting Trend Following (STF) which remains a separately managed account offering and ‘1940 Act Fund from Flexible Plan Investments. In 2014, his second algorithmic system Tactical Unconstrained Growth (TUG) was created, and it too has been used as a separately managed account and 1940 Act Fund, this time through Q3 Asset Management. Additionally, TUG is an ETF model on Transamerica’s TransOne platform through NASDAQ DorseyWright.

It’s too early to evaluate but pasted the performance anyway:

TUGN seeks long-term growth of capital and current income. TUGN is an income solution with a rules-based approach to asset allocation. Powered by the Tactical Unconstrained Growth (TUG) Model signals which were used in 2014, with analysis of data that expands over decades. The TUGN strategy seeks to generate a less correlated source of income, along with the potential to dampen equity volatility and downside risk. The TUG Model allows for the optionality of generating potential monthly income through a systematic, rules-based approach using index options.

TUG is one of the issuers first ETFs. It utilizes a proprietary, quantitative model to allocate between equity exposure through the NASDAQ-100 index, and fixed income using US Treasury bonds and bills/cash equivalents. The model uses an algorithm-based signals that track shifts in price action, market volatility, and correlation across equities, fixed income, and commodities. Based on these signals, the funds adviser will adjust the allocations to proactively adapt to current market conditions. In this way, TUG hopes to identify which asset class provides the best opportunity for growth in light of prevailing market conditions. The fund may obtain its exposure directly, or indirectly through other ETFs. Investors should expect active and frequent trading of securities in implementing TUGs strategy, which could result to a higher portfolio turnover rate.

What are the underlying indexes for these two ETFs? No indexes. these are actively managed ETFs, which is a trend now.