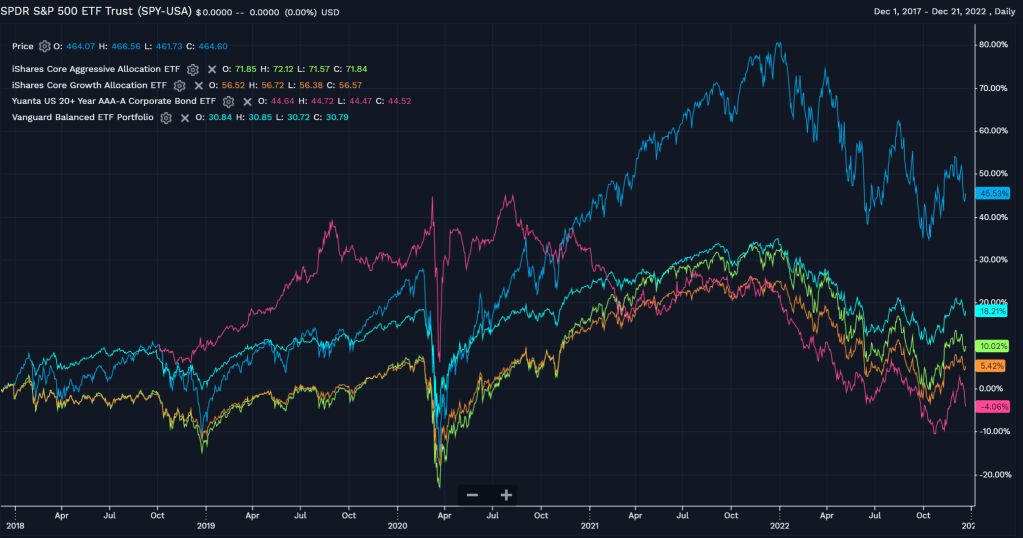

Here are the largest multi-asset ETFs (per AuM) performance

over and over again, these funds never can beat the SPY.

However as indexer, I do need to dive deep to see how the underlying indexes are woven. Taking AOA-US’s benchmark as example by Referencing S&P Target Risk Index Series Methodology.

There are four indexes included:

- S&P Target Risk Conservative Index. The index is made up of 70% fixed income and 30%

equities. - S&P Target Risk Moderate Index. The index is made up of 60% fixed income and 40%

equities. - S&P Target Risk Growth Index. The index is made up of 60% equities and 40% fixed income.

- S&P Target Risk Aggressive Index. The index is made up of 80% equities and 20% fixed

income.

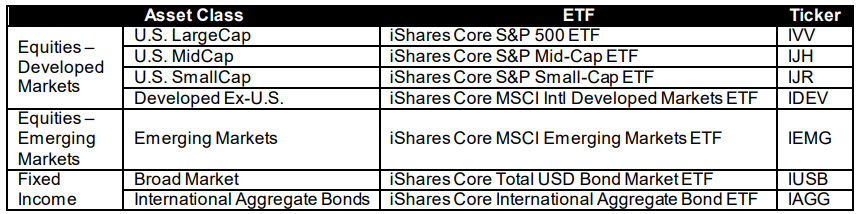

The index series is comprised exclusively of exchange-traded funds (ETFs). To be eligible for inclusion in

the indices, an ETF must track a benchmark that is broadly representative of a major asset class and be

registered as an investment company under the 1940 Investment Company Act.

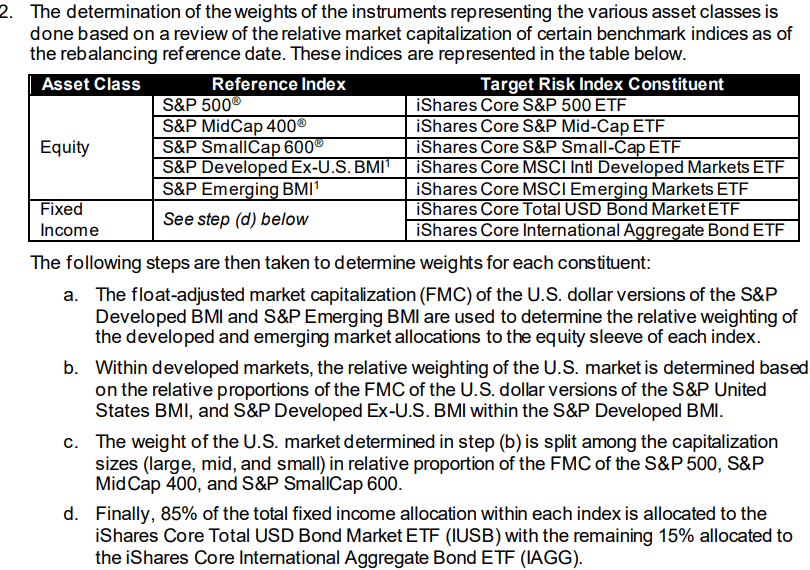

As to the weight schema determination, the details are

What’s to add in recent years is to rotate the selection of conservative, aggressive, moderate and growth based on macro-level economic environment – signal triggering. Theoretically it will better the performance lower volatility.