It’s firm very good at promoting and marketing. However, the performance is king in investment arena.

First to take a look what the FactSet insight say about it: “TAIL holds a portfolio of primarily cash and US government bonds, but the primary strategy of the fund involves investing one percent of its holdings every month in out-of-the-money put options on the S&P 500 Index. The strategy involves buying more puts when volatility is low and fewer puts when volatility is high. The main purpose behind holding these options is hedging a portfolio against significant negative movement in the value of US equities, commonly referred to as tail risk. Cambria intends to target options that are 0 to 30% out of the money. Buying puts further out of the money reduces the price tag of this hedge, but also lessens the amount of downside protection provided.”

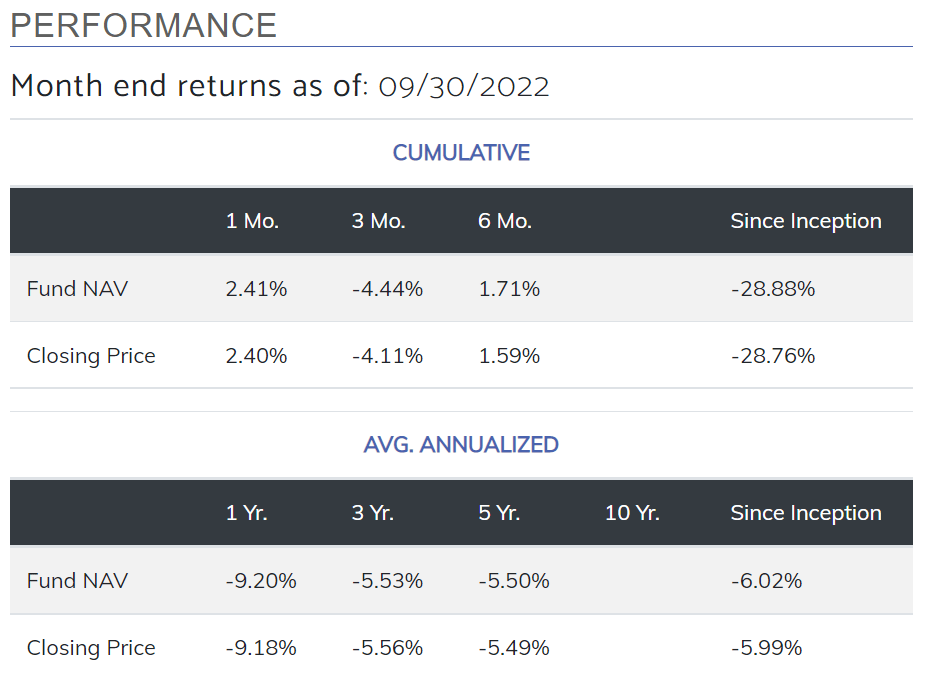

It seems to involve sophisticated operation on buying and selling derivatives to hedge the fat tail risk of US equities. But again, look at its performance since inception:

After reviewing so many funds, it just baffled me why there are so many unsuccessful portfolio managers, yet people still pour money at them knowing they are not far better than monkeys throwing darts. They still have ~$262M AuM.

People like MEB FABER, co-founder and the Chief Investment Officer of Cambria Investment Management, and author of multiple books. They are just good at talking but no substance.