As mentioned in previous blog, GSAM has entered into ETF business and put out an array of products in this page. Other than the early batch of activebeta series, they also used Solactive to construct quite a few thematic indexes/ETFs.

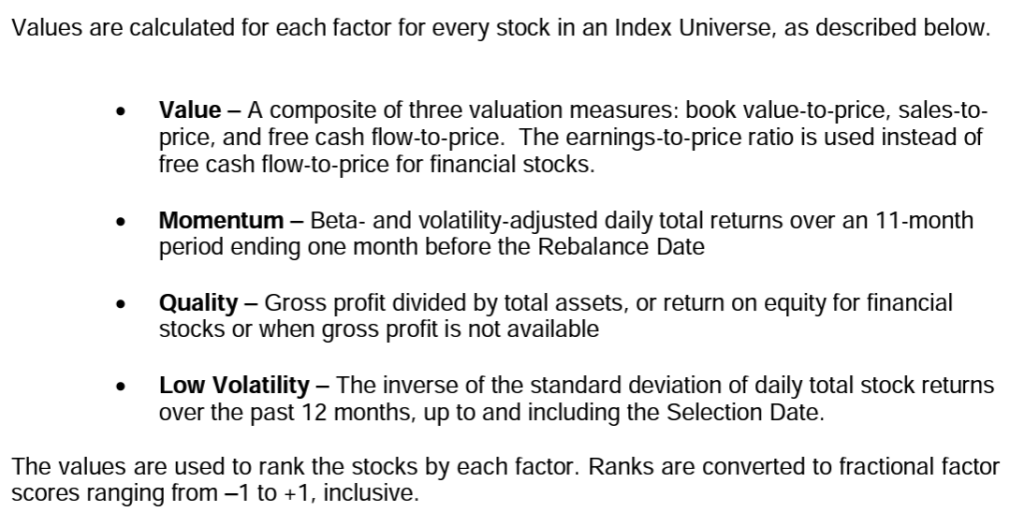

By reading through the methodology pdf on ActiveBeta series. the key notes are collected here. btw, they claimed the construction process is patented.

Use two parameters: the cut-off score and maximum stock underweight. The Cut-off Score determines the proportion of underweights to overweights, and the Maximum Stock Underweight the magnitude of stock weight differences relative to their weights in the Index Universe. The appropriate parameter values for each factor are determined based on historical simulations and are fixed for each ActiveBeta® Index.

Once the factor scores are rescaled, stocks with factor scores greater than 0 are overweighted relative to the Index Universe. Stocks with factor scores less than or equal to 0 are underweighted relative to the Index Universe.

The ActiveBeta® Turnover Minimization Technique reduces the turnover in the ActiveBeta® Equity Indexes by calculating offsetting pair trades in the individual factor subindexes and allowing constituent weights to float inside the upper and lower weight bounds, as defined above. A trade weight is calculated for each stock from the difference between the stock’s weight before rebalancing and the weight determined by the Index Construction Methodology described in Section II. The lower and upper trading bounds allow a stock’s weight to deviate from its target weight, either positively or negatively, before a trade or rebalancing is triggered. Iterative pair-wise trades are netted until the minimum amount of trading is determined which maintains each stock within its upper and lower weight bounds. In the case of the ActiveBeta® U.S. Small Cap Equity Index only, the trade size is further constrained as a function of 60 day median trading volume and the market capitalization of the Russell 2000 Index.

They use Solactive as calculation agency.