Third, CRYPTO_LIQUIDATIONS_REPORTED_FUTURE_BUY_UNITS_1D Total liquidations The sum of all buy liquidations from perpetual futures markets in native units of the underlying base asset.

A breakdown of what it means:

- “Buy liquidations” – This refers to the liquidation of long positions in a perpetual futures contract. Liquidation occurs when the trader’s margin balance falls below the maintenance margin level due to adverse price movements.

- “Perpetual futures markets” – These are futures contracts with no expiration date, allowing traders to hold positions indefinitely. They are popular in cryptocurrency markets for speculating on price movements.

- “Native units of the underlying base asset” – This means the amount is measured in the actual cryptocurrency being traded, rather than quote currency like USD. For example, if trading Bitcoin perpetual futures, the liquidations would be measured in BTC.

So in simple terms, it quantifies the total sum of all long positions, denominated in the cryptocurrency itself (e.g. BTC, ETH), that were forcibly closed due to insufficient margin in perpetual futures markets over a given time period.

This metric provides insight into the scale of buying pressure being unwound in the derivatives market during periods of heightened volatility or market crashes. Higher buy liquidation levels can sometimes exacerbate sell-side pressure, contributing to further downward price movements.

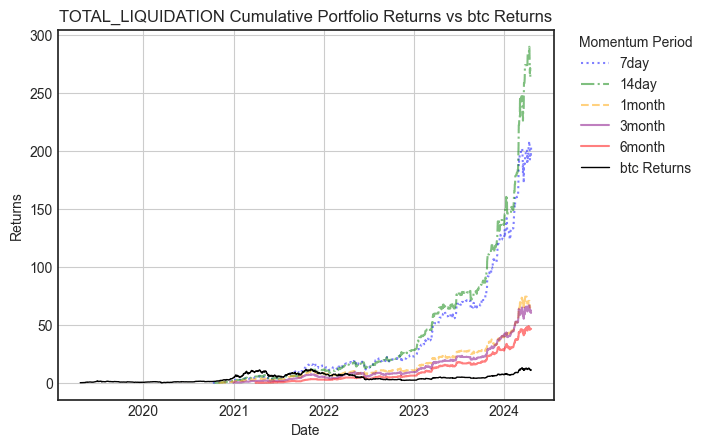

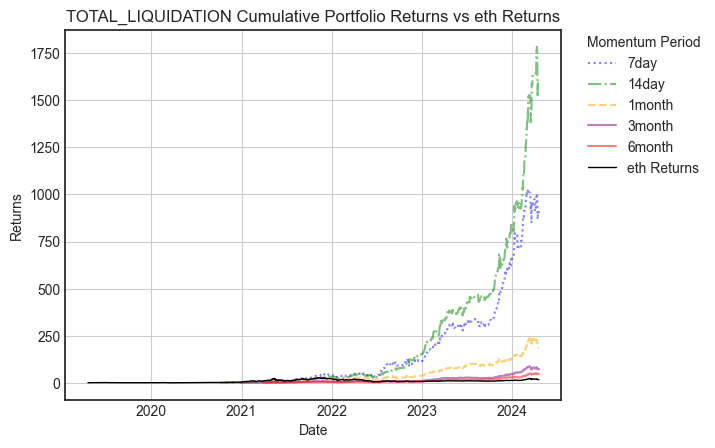

Research papers and studies that have explored using total liquidations, specifically the sum of buy liquidations from perpetual futures markets, as a potential indicator or signal for cryptocurrency investment strategies. Here are a few examples:

- “Liquidation Events as Drivers of Cryptocurrency Returns” by Yuri Biondi and Xiaohui Chen (2021)

This paper investigates the impact of liquidation events in the Bitcoin and Ethereum perpetual futures markets on the respective cryptocurrency’s returns. The authors find a significant relationship between buy-side liquidations and downward price pressure, suggesting that tracking liquidations could be useful for trading strategies. - “Trading Strategies Using Liquidation Data on Cryptocurrency Perpetual Futures Markets” by Yukun Liu et al. (2022)

This study proposes several trading strategies based on liquidation data from cryptocurrency perpetual futures markets, including signals derived from buy-side liquidation volume. The authors backtest these strategies and find that incorporating liquidation data can improve risk-adjusted returns compared to buy-and-hold strategies. - “Cryptocurrency Liquidation Events and Market Dynamics” by Liyu Zhi et al. (2021)

While not directly focused on investment strategies, this paper analyzes the impact of liquidation events in perpetual futures markets on the underlying cryptocurrency’s volatility and price dynamics. The authors suggest that monitoring liquidations could help traders and investors better understand market conditions and risks. - “Quantitative Trading Strategies for Cryptocurrency Perpetual Futures” by Tianyu Wu (2022)

This master’s thesis explores various quantitative trading strategies for cryptocurrency perpetual futures, including strategies that incorporate liquidation data as a signal. The author finds that strategies utilizing liquidation information can potentially improve performance during certain market conditions.