A more robust version of the passive factor testing was conducted using two universes: the U.S. large-cap, proxied by MSCI USA (US-MSX, Id = 98400), and the U.S. small-cap, proxied by the Russell 2000 (R.2000). The dataset provides solid coverage dating back to 20000829.

Initial results already showed some signals, and after further testing, it was more certain that the passive factor does not exhibit a significant signal in the large-cap universe, but does show an alpha signal in the small-cap universe.

The following analysis focuses on the MSCI USA (U.S. large-cap) universe.

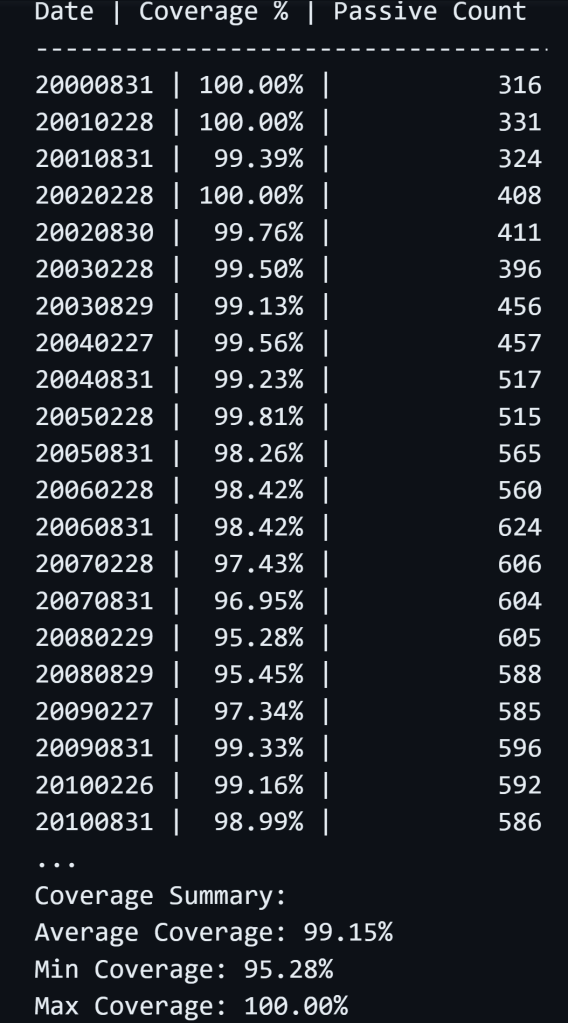

Coverage check:

Data attributes: i. passive percent shifting upward along the history; ii. histogram of passive ownership across the whole universe:

The passive factor is normalized and adjusted as follows: use Z score to standardize first, then capped in between numpy.clip(z_scores, -3, 3), and sigmoid function to smooth up: sigmoid(x) = 1 / (1 + e^(-x)).

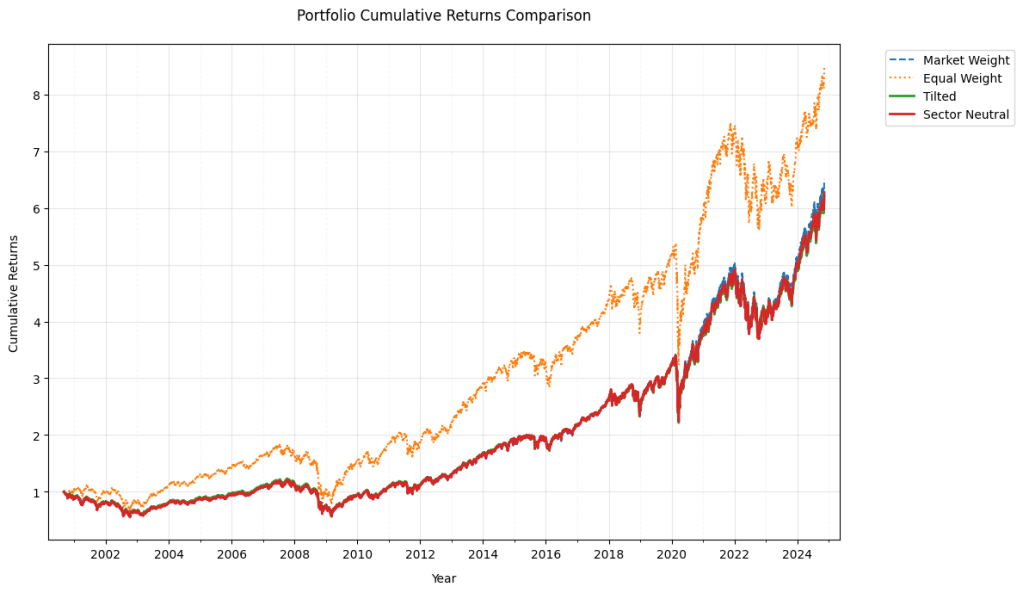

Next, we construct the portfolios of market cap, equal, passive factor tilted and sector neutralized passive factor tilted weightings, then compare their performance:

All is saved up in my github repo of passive_factor