With the rise of AI, traditional Quant Workflow is simply primitive.

The traditional research workflow is increasingly inadequate in today’s data-rich environment. It often begins with a dataset containing hundreds of dimensions, where manually designing features is not only time-consuming but also inefficient. In contrast, AI-driven approaches leverage machine learning algorithms to automatically generate these features, significantly speeding up the process.

Reinforcement Learning (RL) takes this a step further by optimizing trading strategies through interaction with a trading simulator, rather than relying on the outdated back-testing functions of traditional methodologies.

AI technologies offer unparalleled flexibility and capabilities that far exceed those of existing traditional research tools. However, building an AI-centric research workflow from scratch can be time-consuming. It’s clear that the reliance on traditional research workflows must be replaced with advanced AI methodologies to keep pace with the demands of modern finance.

There are several offerings in this arena: QuantLib, a free and open-source library for modeling, trading, and risk management in finance; FinRobot, an open-source AI agent platform for financial tasks that supports multiple AI agents powered by LLMs; and Qlib, developed by Microsoft, which is an AI-oriented quantitative investment platform.

in this blog, I will explore Qlib codes, next blog would be about QuantLib. As I already have dived deep to FinRobot earlier.

First, get_data function allows it to retrieve US and CN data remotely by running its lines.

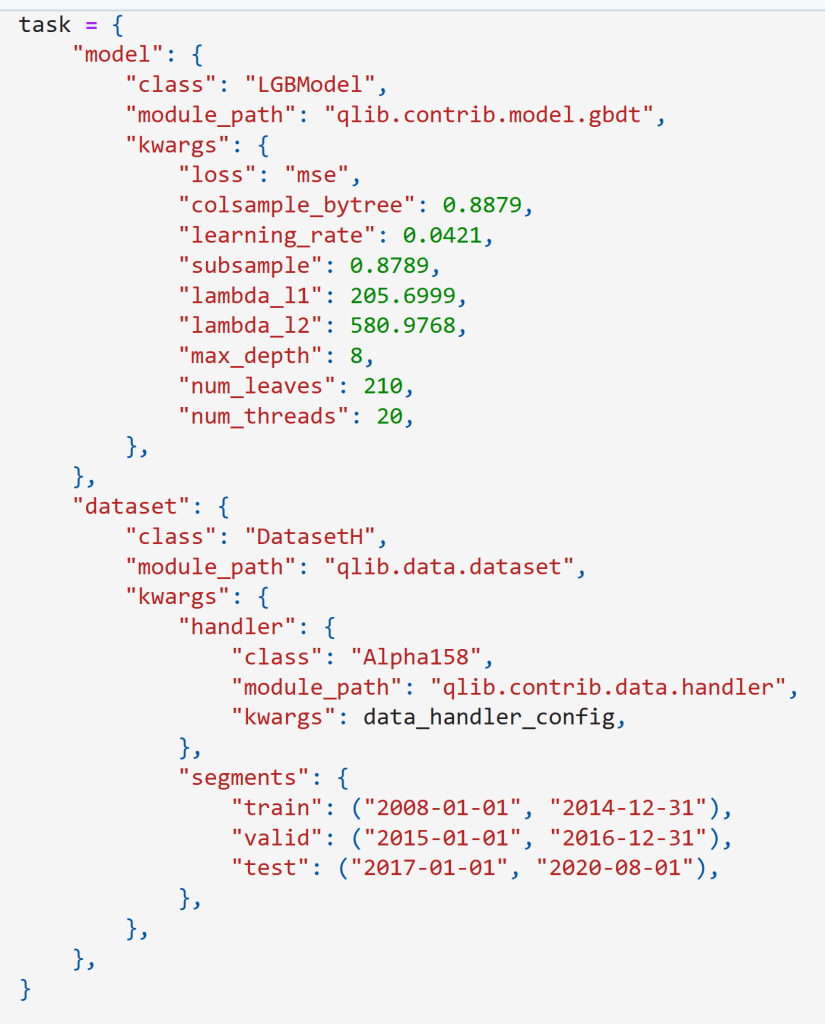

Second, utilize it’s example notebook codes to find the key settings:

Note LGBModel, or LightGBM Model, is a machine learning algorithm based on the LightGBM (Light Gradient Boosting Machine) framework. It is a gradient boosting model that uses tree-based learning algorithms. under qlib /qlib /contrib /model, there are bunch of models. catboost, double_ensemble, gbdt, i.e. lightgbm, highfreq_gdbt, linear, adarnn, alstm, gats, general_nn, pytorch_gru_ts, pytorch_lstm etc.

It tested Alpha158 is a comprehensive set of 158 technical indicators used in quantitative finance, particularly for stock market analysis and prediction. Alpha158 and Alpha360 are two different datasets used in quantitative finance, each with its own characteristics and performance implications. Alpha360 is raw, higher dimensional, require deep learning model such as GRU to handle, while Alpha158 delivers higher performance, worked well with LightGBM.